S&P 500 Outlook Talking Points:

- Bank of America failed to impress analysts, weighing on the financial sector and the S&P 500

- The sector will now look to Morgan Stanley’s report due Wednesday as Netflix kicks off tech earnings

- Interested in live currency analysis? Sign up for one of our free trading webinars.

S&P 500 Outlook: Bank Earnings Divided Ahead of Morgan Stanley

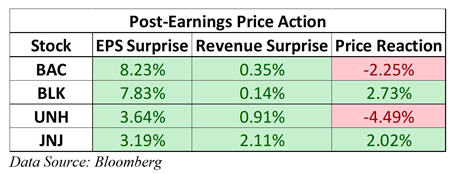

With earnings season well underway, bank results remain divided. After Goldman Sachs dragged the Dow Jones lower on Monday, Bank of America (BAC) followed suit on Tuesday, declining 2.25%. On the other hand, Blackrock (BLK) delivered a healthy earnings surprise, which saw shares climb 2.7% in Tuesday trading.

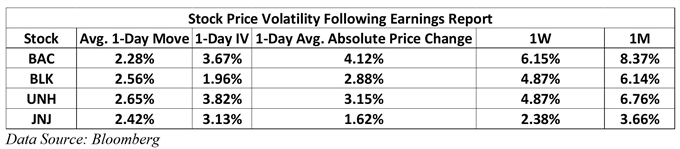

Two Dow Jones giants - United Health Group (UHN) and Johnson & Johnson (JNJ) – also offered split performances Tuesday. Together, the two corporations account for nearly 9.50% of the Industrial Average with United Health taking the lion’s share. Three of the four stocks saw larger intraday moves than their average following an earnings report, with JNJ being the exception. Conversely, every stock saw a smaller reaction than one-day implied volatility had suggested - thus trading within the expected price range.

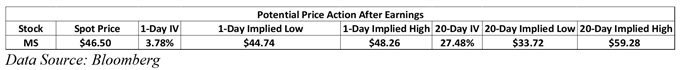

As financials conclude for the season, Morgan Stanley’s (MS) report on Wednesday morning will deliver the last of the results from the banking giants. The Street is expecting $1.17 earnings per share on $10.00 billion in revenue. One-day implied volatility suggests Morgan Stanley shares will trade between $44.74 and $48.26 following the report.

Morgan Stanley Earnings Preview

While noteworthy, especially for the financial sector, the report may be overshadowed by the advent of tech earnings – namely Netflix. As a member of the FAANG group, Netflix is often afforded considerable influence over market sentiment. Follow @PeterHanksFX on Twitter for further market insight and updates.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Dow Jones, S&P 500, DAX 30, and FTSE 100 Technical Forecast

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.