Gold price, news and analysis:

- A slowing global economy and continuing worries about trade wars are boosting the attractions of safe-haven gold.

- Worried central bankers, a downbeat IMF and the imminent start of the US corporate earnings season are adding to demand for the precious metal.

Gold in demand

The price of gold is trading close to its highest level since March 28 but further gains could yet be in store as investors seek out haven assets on concerns about a weak global economy and the ongoing trade disputes between the US on one side and both China and the EU on the other.

From a recent low of $1,280.98 per ounce on April 4, the gold price has already climbed to a high of $1,310.69 Wednesday but further gains are still possible, perhaps after a short period of consolidation. As the chart below illustrates, gold continues to trade within the rising channel in place for most of this month so far and even a near-term fall below $1,300 would do little to damage its prospects.

Gold Price Chart, One-Hour Timeframe (April 4-11, 2019)

Chart by IG (You can click on it for a larger image)

From an economic perspective, one key driver remains fear of a global slowdown and, in particular, talk of a US recession. Although the prospect of such a recession may well have been exaggerated, safe-haven gold remains the go-to asset for worried investors.

The ongoing trade wars between the US and China, as well as between the US and the EU, are also polishing gold’s shine, as are jitters ahead of the start of the US corporate earnings season.

Fed, ECB and IMF all downbeat on growth

On Wednesday, the US Federal Reserve’s minutes of its March 19/20 meeting showed the central bank is no longer sure about higher interest rates in 2019. “A majority of participants expected that the evolution of the economic outlook and risks to the outlook would likely warrant leaving the target range unchanged for the remainder of the year,” it said.

The European Central Bank was pessimistic too. “The risks surrounding the euro area growth outlook remain tilted to the downside, on account of the persistence of uncertainties related to geopolitical factors, the threat of protectionism and vulnerabilities in emerging markets,” said ECB President Mario Draghi.

That followed cuts by the International Monetary Fund in its growth projections for 2019 and 2020. “While a global recession is not in the baseline projections, there are many downside risks,” said IMF Chief Economist Gita Gopinath.

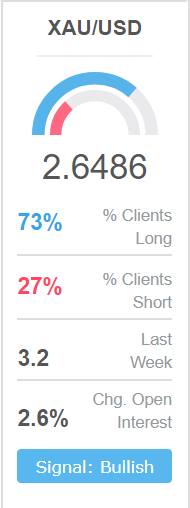

As for the positioning of retail traders in the gold market, IG Client Sentiment figures show almost three quarters of them are long. At DailyFX we take a contrarian view of crowd sentiment and that too suggests further upside potential for the gold price.

You can read plenty more about gold here

And here are the top gold trading strategies and tips

Resources to help you trade the markets:

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you:

- Analytical and educational webinars hoste several times per day,

- Trading guides to help you improve your trading performance,

- A guide specifically for those who are new to forex,

- And you can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex