CURRENCY VOLATILITY: EURUSD, ECB, FED – TALKING POINTS

- EURUSD overnight implied volatility nearly doubled from 4.65 percent to 8.39 percent, the metric’s highest reading since March 7

- The jump in anticipated price action is likely in response to potential market-moving event risk from the April ECB meeting and March Fed minutes release tomorrow

- Check out this article for information on the Top 10 Most Volatile Currency Pairs and How to Trade Them

- Download the free DailyFX Trading Forecasts for comprehensive second quarter outlook on the US Dollar, Euro, British Pound, Japanese Yen, Gold, Oil and Equities

EURUSD overnight implied volatility has soared to a one-month high ahead of key event risk posed by the ECB meeting and Fed minutes expected tomorrow. The 1-day implied volatility measure now sits at 8.39 percent which suggests a potential move of 49 pips during Wednesday’s session.

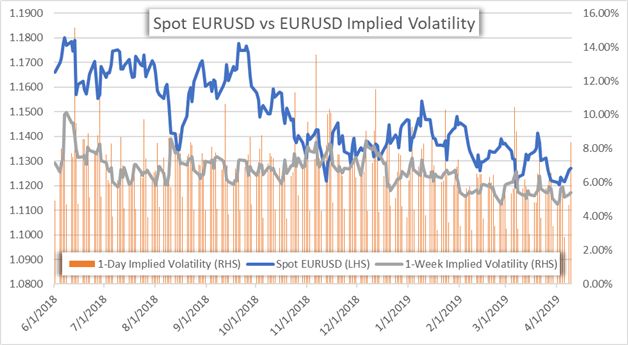

EURUSD IMPLIED VOLATILITY PRICE CHART: DAILY TIME FRAME (JUNE 01, 2018 TO APRIL 09, 2019)

Although, overnight implied volatility remains elevated ahead of key event risk tomorrow, expected price action measures show a slow-and-steady decline overall. The waning trend is likely in response to the most liquid currency pair notching its narrowest trading range since August 2014 according to the 14-day ATR.

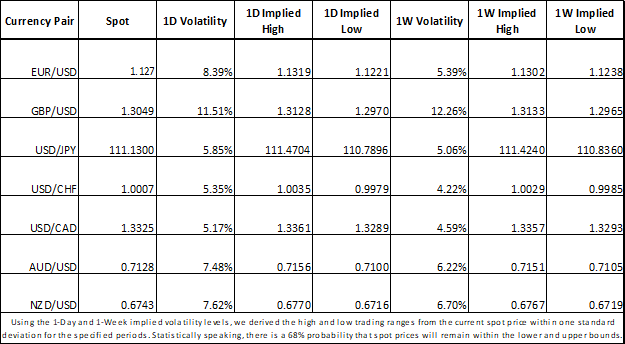

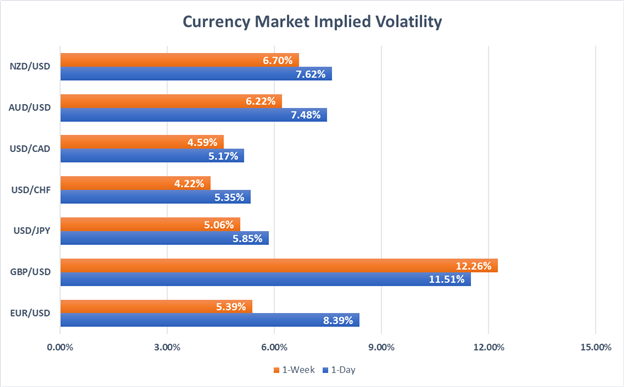

FOREX MARKET IMPLIED VOLATILITIES AND TRADING RANGES

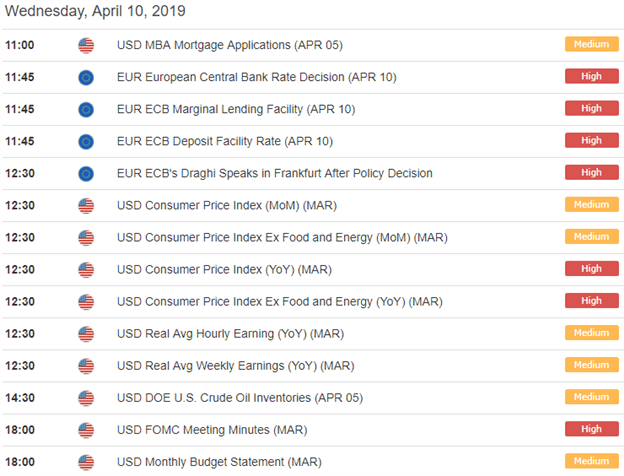

The ECB is expected to announce its April monetary policy update at 11:45 GMT Wednesday. Markets will likely focus on supplementary commentary from ECB President Mario Draghi, however, seeing that OIS futures are pricing a 96.7 percent chance that the ECB holds its policy interest rate at -0.40 percent.

Aside from the ECB, the US is due to release its latest consumer price index which is projected to show muted signs of inflation. The headline and core CPI measures are slated to cross the wires at 12:30 GMT. If the inflation readings are reported higher than expected, the Fed could be forced to rethink its recent dovish tilt which could support the US Dollar.

FOREX ECONOMIC CALENDAR – EURUSD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

The Federal Reserve’s FOMC minutes from its March meeting is scheduled for release at 18:00 GMT and will likely cap off Wednesday’s busy session for EURUSD traders. The report is expected to provide further insight on the Fed’s latest dovish position following its decision to cut economic projections and plan to end balance sheet normalization. Language from Fed officials that bolsters confidence by touting a strong economic backdrop could bolster the US Dollar while a tepid stance that leaves the door open for further policy easing may put downward pressure on the USD.

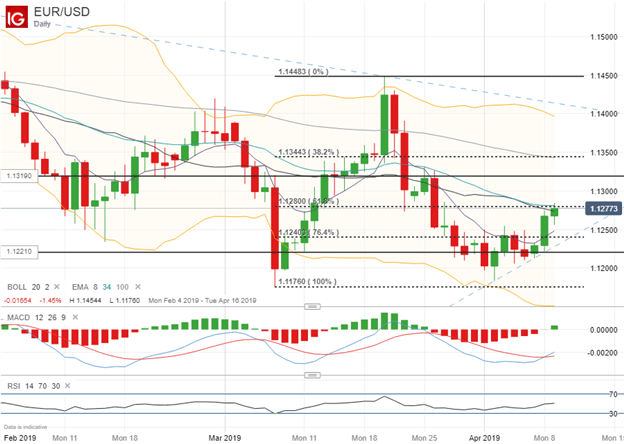

EURUSD PRICE CHART: DAILY TIME FRAME (FEBRUARY 04, 2019 TO APRIL 09, 2019)

Spot EURUSD is trading slightly below the 1.1300 handle after rallying off support found at the 1.1200 price level. The derived trading range calculated from EURUSD overnight implied volatility sees the currency pair trading between 1.1221 and 1.1319 with a 68 percent confidence interval. However, the recent uptrend formed could provide support near the 76.4 percent Fibonacci retracement line which rests near the 1.1250 price level. Resistance posed by the 61.8 percent Fib and 100-day EMA could hinder EURUSD upside.

Check out additional EURUSD technical analysis here.

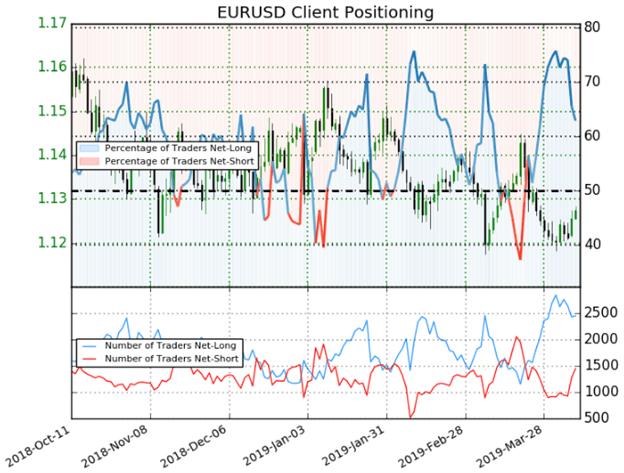

EURUSD TRADER CLIENT SENTIMENT

Check out IG’s Client Sentiment here for more detail on the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin and S&P500.

According to client positioning data from IG, 62.8 percent of traders are net long-resulting in a ratio of 1.69 traders long to short. However, the percent of traders net-long is 10.6 percent and 13.8 percent lower relative to the data readings yesterday and last week respectively.

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter