Asia Pacific Markets Wrap Talking Points

- Asia Pacific equities trade sideways on competing news

- Japanese Yen keeps gains on EU-US trade war concerns

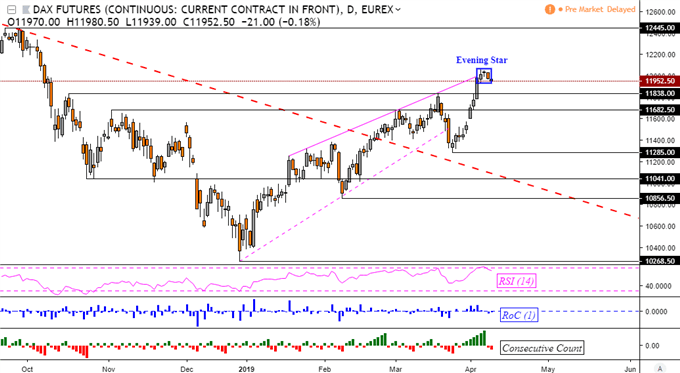

- DAX 30 may be topping on technical cues, eyes support

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

Asia Pacific benchmark indexes traded sideways on Tuesday, heading into the close with varying degrees of cautious gains. Japan’s Nikkei 225 was around 0.1% higher while China’s Shanghai Composite fared slightly better. Meanwhile, Australia’s ASX 200 declined about 0.05%.

A couple of fundamental developments were competing for market attention after the S&P 500 only just closed 0.1% to the upside beforehand. On the upside, multinational conglomerate Sony received a boost after hedge fund Third Point was reported building a stake in the company.

On the flipside, rising concerns about a EU-US trade war momentarily sent equities lower in a moment of risk aversion. Looking at currencies, the anti-risk Japanese Yen gained and held onto its progress despite a slight uptick in sentiment towards Tokyo Stock Exchange close.

The pro-risk Australian and New Zealand Dollars eventually found support. However, risk appetite may be vulnerable to the upcoming IMF/World Bank Spring meeting which could highlight the prolonged uncertainty about the outlook for global growth. Technical developments in German shares also hint that sentiment may sour next, S&P 500 futures are pointing narrowly lower.

DAX 30 Technical Analysis

On a daily chart below and looking at futures to show afterhours trade, the DAX may be on the verge of topping. That is because prices have left behind an Evening Star at the recent peak above 12000. Confirming a turn lower would however require further closes to the downside where support seems to be at 11838.

DAX Daily Chart

Chart Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter