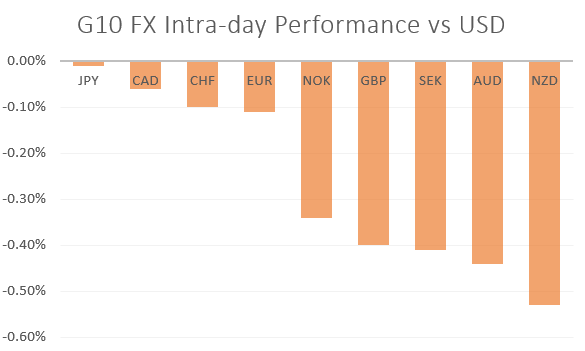

MARKET DEVELOPMENT –EURUSD Breaks Below 1.12, GBPUSD Drops on Brexit Deadlock

GBP: As the Brexit impasse continues with MPs failing to reach a majority on any Brexit alternatives in yesterdays indicative votes, the Pound subsequently gave up its recent gains with the currency hovering around 1.3020 against the greenback (at time of writing). Headline risk remains elevated as we move towards April 12th, focus will be on the fallout of today’s cabinet meeting. On the data front, the construction PMI remained contractionary territory for a second consecutive month for the first time since August 2016. Eyes on tomorrows services PMI.

AUD: Overnight, the RBA kept interest rates unchanged at 1.50%, however, the Australian Dollar dipped in reaction to the more cautious statement. In the near-term AUDUSD topside looks to be somewhat limited with $3.7bln worth of vanilla options rolling off at 0.71 throughout the week, while the 50 and 100DMAs reside at 0.7118 and 0.7150 respectively. Key support remains situated at the psychological 0.70 handle.

EUR: Subdued price action in the Euro this morning, which has posted a tight 27pip range, albeit at the lower end of the longer-term range with EURUSD briefly breaking below the 1.12 handle.

Source: Thomson Reuters, DailyFX

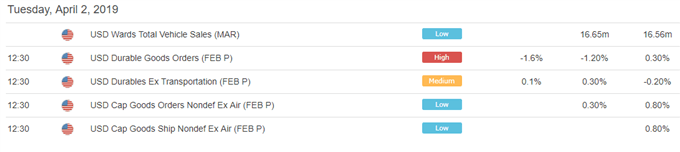

DailyFX Economic Calendar: – North American Releases

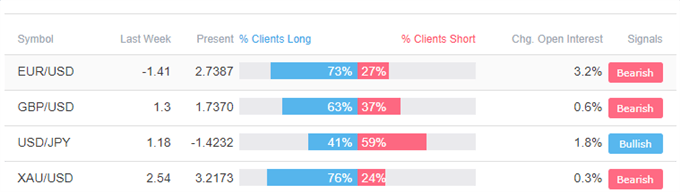

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “GBPUSD Price Rattled as EU Says No Deal Brexit Now More Likely” by Nick Cawley, Market Analyst

- “AUDUSD Topside Limited as RBA Raises Risk of Near-term Rate Cut” by Justin McQueen, Market Analyst

- “Trading Outlook for EURUSD, AUDUSD, AUDNZD, Gold Price & More” by Paul Robinson , Market Analyst

- “Crude Oil Price Challenges Channel Resistance” by Martin Essex, MSTA , Analyst and Editor

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX