GBP Price, News and Brexit Latest

- Indicative votes back on Parliament’s agenda.

- US Labour report rounds off the week.

Q1 2019 GBP Forecast and USD Top Trading Opportunities

Brexit Latest and US Labour Report (NFPs)

MPs will be voting on a selection of indicative bills early evening in a fresh attempt to get a Brexit consensus position after the previous vote saw all bills fail. The British Pound has found some support from talk that if a soft Brexit option is successful, then PM May will try and bring her meaningful vote back to the House for a fourth time to try and force it through with the backing of Conservative Brexiteers and the DUP.

GBPUSD Price Pushing Higher Ahead of Fresh Brexit Votes.

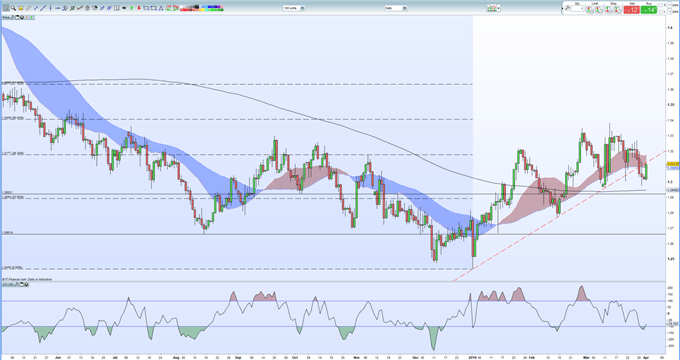

Sterling has moved higher during the session against a range of currencies but further upside against the US dollar is currently blocked by the old support trend line which is now acting as resistance. A break above is possible if a softer Brexit is mooted, or if PM May’s bill passes, while traders should also be aware of several important US data releases during the week, culminating in the monthly NFP report on Friday.

GBPUSD Threatens Bull Trend Ahead of Brexit Deadline.

GBPUSD Daily Price Chart (May 2018 – April 1, 2019)

Sterling Weekly Technical Outlook: No Brexit Deal – Pound Losses Mount.

Retail traders are 61.0% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. See how recent daily and weekly positional changes affect GBPUSD sentiment.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.