EURUSD Price, Chart and Analysis:

- EURUSD sitting just above 1.1200 as lower highs continue.

- CCI indicator is in oversold territory – will it spark a bounce?

- Retail traders have increased net-long positioning sharply in the last week.

Q1 2019 EUR Forecast and USD Top Trading Opportunities

The pattern of lower highs, and lower lows to date, highlight the weakness of the single currency against a resurgent US dollar. The pair hit a recent peak around 1.1450 less than two weeks ago before the bearish longer-term pattern reasserted itself, prompting the pair to fall sharply lower. The speed of the recent fall has pushed EURUSD into oversold territory using the CCI at the bottom of the chart, and this may see a small bounce in the pair within a longer-term bearish pattern. This, potential, short-term pullback may also be aided by the recent breakdown in this pattern of lower highs – the pattern was broken on March 20 while the lower low pattern is still in place. This may see the pair range trade in the short-term, again offering the opportunity for a small technical retracement.

Euro Weekly Technical Outlook: EURUSD Rejected by 200-DMA Again.

EURUSD Daily Price Chart (August 2018 – March 29, 2019)

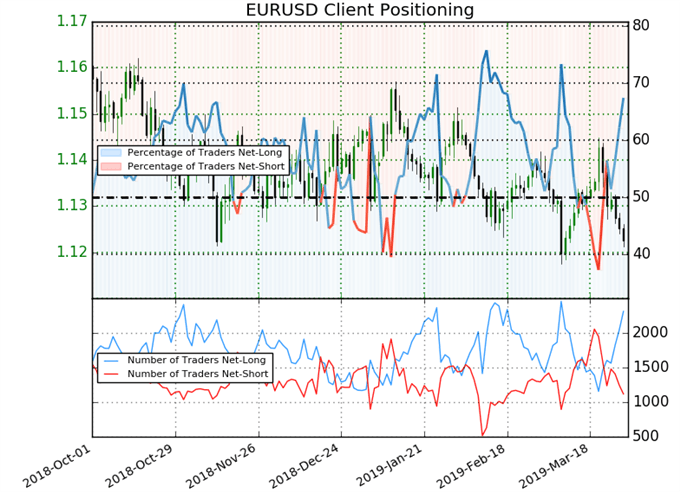

Retail traders are 67.4% net-long EURUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent substantial changes in daily and weekly sentiment, increasing retail traders net-long positions, give us a stronger bearishtrading bias for EURUSD.

We run a number of Trader Sentiment webinars every week explaining how to use client sentiment data and positioning when looking at a trade set-up. Access the DailyFX Webinar Calendar to get all the times and links for a wide range of webinars and topics.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.