GBP price, news and analysis:

- Members of the UK Parliament will vote Wednesday on a series of Brexit options.

- High volatility in GBPUSD makes trading difficult.

Brexit still in spotlight for Sterling traders

Sterling is continuing to weaken against the US Dollar ahead of another important day for Brexit but day traders need to be careful given the persistent high volatility in GBP.

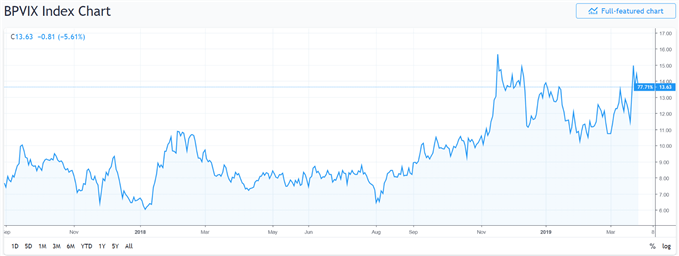

CBOE CME FX British Pound Volatility Index

Source: Tradingview.com

The Westminster Parliament will attempt to find a way through the Brexit maze by voting on a series of alternatives ranging from the UK leaving the EU without a deal to the cancellation of Brexit. The so-called indicative votes are a way of trying to find a way of leaving the EU that commands a majority among Members of Parliament, with a customs union, a common market or a single market without a customs union (the so-called Norway plus option) all likely to be voted on.

However, all this will happen after the European close, with UK Prime Minister Theresa May expected to address the 1922 Committee of Conservative backbenchers around 1700 GMT, the “indicative votes” to begin around 1900 GMT and the results due after 2100 GMT. Moreover, the UK Government will not necessarily pursue any plan that Parliament agrees on.

May to quit?

Some political analysts expect May to offer to quit if that will help her current deal with the EU to pass, and she will have been emboldened by the possible support of the Brexit hardline European Research Group of Conservative MPs. However, she seems not to have won the support of Northern Ireland’s Democratic Unionist Party that props up her minority government – meaning her deal with the EU will likely be rejected for a third time if it is one of the alternatives put to Parliament.

In the meantime, GBPUSD remains in the downtrend that began early this month but there is no clear sign of how it will react to the voting, making it difficult to forecast near-term.

GBPUSD Price Chart, Hourly Timeframe (March 7 – 27, 2019)

Chart by IG (You can click on it for a larger image)

More to read:

Using News and Events to Trade Forex

Resources to help you trade the forex markets:

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you:

- Analytical and educational webinars hosted several times per day,

- Trading guides to help you improve your trading performance,

- A guide specifically for those who are new to forex,

- And you can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex