GBP Price, News and Brexit Latest

- PM May future remains unclear as MPs plot ouster.

- Sterling remains stable, but clarity needed before next move.

Q1 2019 GBP Forecast and USD Top Trading Opportunities

Brexit Latest – PM May Under Pressure to Resign

The latest chapter in the Brexit saga sees UK PM Theresa May looking over her shoulder as hardline Brexiteers plot to oust the Conservative leader. Various stories over the weekend suggest that either the PM will resign early if MPS back her Withdrawal bill if it is presented to Parliament again this week or that the Prime Minister will be forced to stand down to let another leader steer a new course in Brexit negotiations. The British Pound is relative sanguine about these rumors, indicating that the market no longer feels that the PM is the best person to continue Brexit discussions with the EU.

Later today, Members of Parliament are expected to discuss a series of Brexit options with talk that there may be as many as six indicative votes put to the House on Wednesday to see if a consensus can be found. On Tuesday the PM may seek to put her Withdrawal bill back in front of Parliament for a third time although she will only do this if she is confident that it will be voted through.

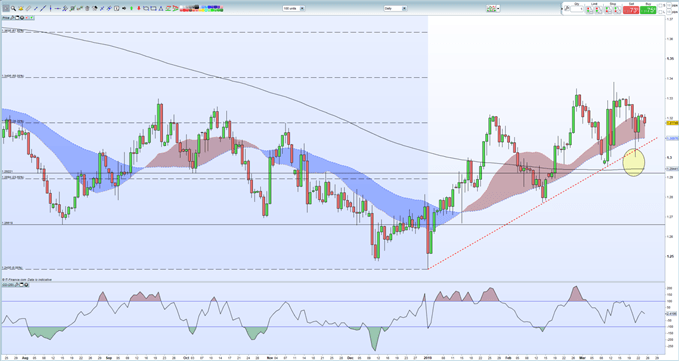

Sterling remains stable, especially so for a currency where a change of leadership is mooted and continues to respect the uptrend started at the beginning of the year. This trend line was broken briefly last Thursday but GBPUSD has since pushed higher, although a series of lower highs over the last two weeks cast a bearish shadow on the pair. The 38.2% Fibonacci retracement level around 1.3175 is acting as a pivot today with support down provided by the 50-day moving average at1.3100 and the trend line around 1.3065.

GBP Fundamental Forecast: And the Brexit Band Played On.

GBPUSD Daily Price Chart (July 2018 – March 25, 2019)

British Pound Volatility Continues and a Break is Inevitable.

Retail traders are 50.2% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest a mixed GBPUSD bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.