GBPUSD Price, Volatility and Brexit

- PM May needs the backing of the DUP to help her deal get across the line.

- Likely that March 29 Brexit day will be pushed back.

Q1 2019 GBP Forecast and USD Top Trading Opportunities

Talk over the weekend that PM Theresa May was trying to win over the DUP and get them to vote for her withdrawal agreement will drive Sterling in the short-term. Over the weekend, Chancellor of the Exchequer Philip Hammond said that there would not be a third vote unless ‘enough of our colleagues and the DUP are prepared to support it’ and added that even if PM May got enough support that it was now ‘physically impossible’ to leave by the end of March. Speculation swirled that the government were preparing to offer Northern Ireland a financial settlement if the DUP voted for the withdrawal agreement, something denied but not categorially. As we write, the DUP have said that they will not be bounced into a deal and that for them it remains all about the integrity of the agreement.

If PM May’s third attempt at passing her withdrawal agreement is rejected once again, then it is very likely that the UK will ask the EU for an extension to Article 50, and this may be lengthy. The PM will use the threat of this delay to warn MPs that Brexit may never happen. If they refuse to vote for her deal, it makes a second referendum more likely. PM May however may well not be around by then, with talk growing daily of dissatisfaction with her leadership and with fresh leadership bids lining up in the background.

The EU 27 leaders will meet on Thursday (March 21) to discuss the latest developments following the UK’s notification to leave the European Union.

GBP Fundamental Forecast: Brexit Meaningful Vote – Third Time Lucky?

GBPUSD –Technical Analysis

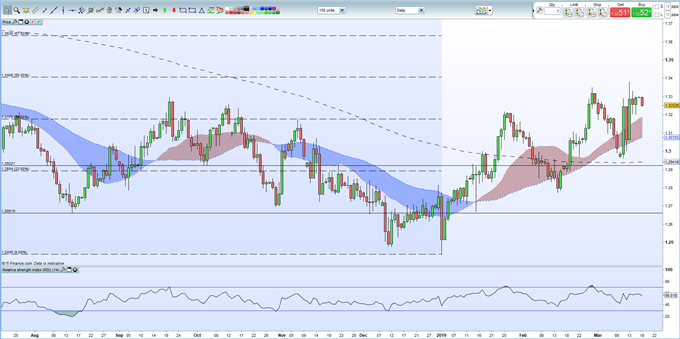

Sterling has moved lower on the latest DUP talk but remains reasonably well bid as we head into a critical week for the UK PM. Sterling charts look positive against most currencies and dips are being bought over the past few weeks with higher lows dominating charts. Volatility is expected to remain elevated over the next two weeks with small, sharp moves likely within recent, defined trading ranges.

Sterling Weekly Technical Outlook: Charts Highlight Bullish GBP Bias

GBPUSD Daily Price Chart (July 2018 – March 18, 2019)

Retail traders are 46.6% net-long GBPUSD according to the latest IG Client Sentiment Data, a bullish contrarian indicator. Recent changes in daily and weekly sentiment however give us a stronger GBPUSD bullish contrarian bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.