MARKET DEVELOPMENT – GBPUSD STEADY, EURUSD RISE HALTED

GBP: Following the decision by parliament to vote for an Article 50 extension, GBPUSD is relatively stable with 1.33 continuing to remain a stumbling block for the pair. While no-deal Brexit risks continue to recede following this week’s votes, the Pound is not out of the woods yet. (GBPUSD trade outlook with IG TV, click here).

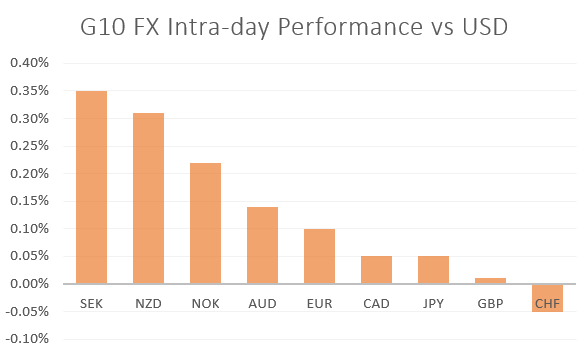

AUD / NZD: Given the improved risk tone with equity prices edging higher, AUD and NZD have been among the main beneficiaries. As a reminder, with today being quadruple witching, upside in equity markets may be somewhat exacerbated, thus keeping high beta FX pairs supported. Looking ahead to next week, key focus will be on NZ GDP and AU Jobs data.

EUR: The Euro has found support above 1.13 amid the softer greenback, however, upside has been capped at 1.1325-30 with $3.3bln worth of option expiries rolling off at 1.1305-1.1325. Alongside this, the continued narrowing of US/German interest rate differentials have also helped provide an undertone of support for the pair for now.

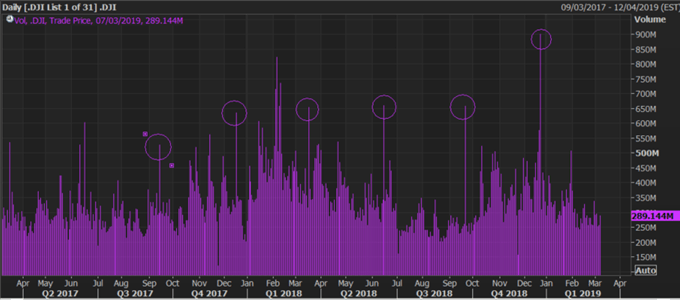

CHART OF THE DAY: QUADRUPLE WITCHING

Source: Thomson Reuters

Source: Thomson Reuters, DailyFX

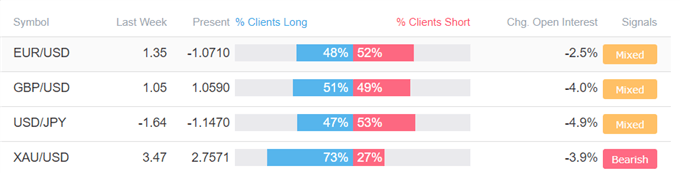

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “Norges Bank: The Only G10 Central Bank to Raise Interest Rates” by Justin McQueen, Market Analyst

- “EURUSD Price Analysis: Further Upside Looks Limited” by Nick Cawley, Market Analyst

- “Charts for Next Week: EURUSD, AUDJPY, Gold Price & More” by Paul Robinson , Market Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

https://www.dailyfx.com/calendar?ref-author=mcqueen