EURUSD Price, Chart and Ifo News:

Q1 2019 EUR Forecast and USD Top Trading Opportunities

The Euro continues to hold just above the 1.1300 level against the US dollar after a steady pick-up from the 21-month low of 1.1175 made one-week ago. The rise has been muted, aided by a weakening US dollar, and now may run into fundamental resistance after a report by the influential German economic institute, Ifo, pointed to a sharp slowdown in growth in Europe’s economic engine in 2019.

According to the Ifo report, “Overall, economic growth in Germany this year is likely to slide by more than half to 0.6% compared to the previous year. Economic growth should recover to 1.8% next year; however, adjusted for calendar effects, the increase will be only 1.4% due to the higher number of working days. Consequently, Germany’s overall economic capacity utilization will continue to decline in the forecast period and reach its long-term average. This means the German economy is in a downswing”.

Earlier Thursday, data showed German inflation missing expectations and last month’s figures with m/m CPI at 0.4% and annual at 1.5%, both 0.1% lower than expectations.

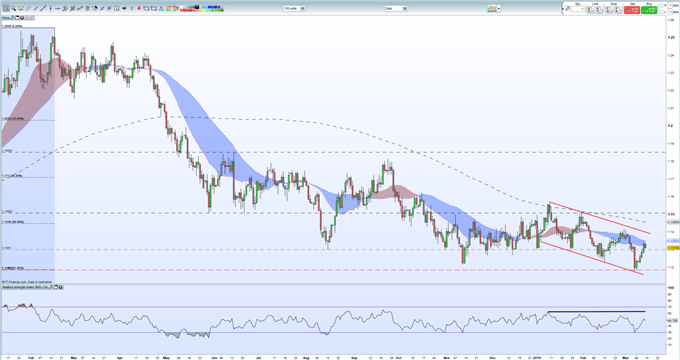

EURUSD remains in a downtrend, started off the January 10 high, with a series of lower highs and lower lows visible. The pair are currently just above the 20-day moving average but below both the 50- and, more importantly, the 200-dmas. The 50% Fibonacci retracement level at 1.1448 should provide stiff resistance for now.

EURUSD Landing Page with Price Analysis, Charts, Pivot Points and Latest News and Views.

EURUSD Daily Price Chart (January 2018 – March 14, 2019)

Retail traders are 48.2% net-long EURUSD according to the latest IG Client Sentiment Data, a bullish contrarian indicator. Recent changes in daily and weekly sentiment however give us a stronger bullish contrarian bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.