EURUSD Price, Chart and US Non-Farm Payrolls:

- The Euro remains under pressure after a dovish ECB meeting.

- US non-farm payrolls will add end of week volatility.

Q1 2019 EUR Forecast and USD Top Trading Opportunities

A bruised Euro remains around the 1.1200 against the US dollar after the ECB yesterday downgraded growth and inflation forecasts, pushed rate hikes back further and announced a fresh round of bank liquidity. The central bank’s action, while supportive for the economy, give further credence to a much lower Euro and multi-year lows remain insight.

EURUSD, EURJPY: Euro Drops as ECB Announces Fresh Round of TLTROs.

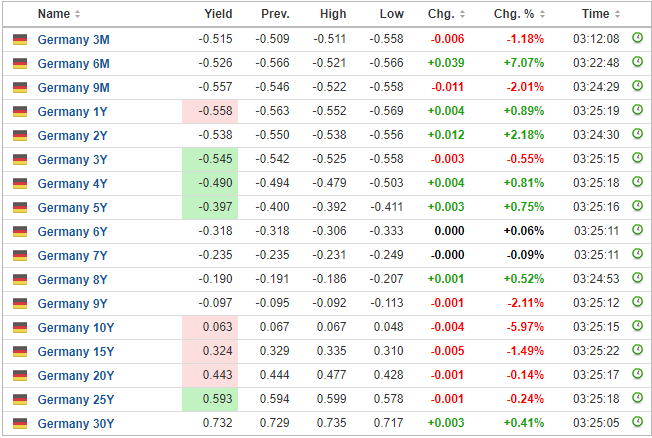

German government bond yields fell further – the curve is in negative territory all the way out to nine years – with the 10-year now yielding just six basis points and back to lows last seen in November 2016. This drop-in yield is in spite of the cessation of the QE program which has helped to drive bond yields lower over the past four years.

The latest German Factory Orders disappointed this morning with a m/m negative figure of 2.6% against predictions of 0.5% growth. The annual figure was also worse than expected at -3.9% against expectations of -3.1%.

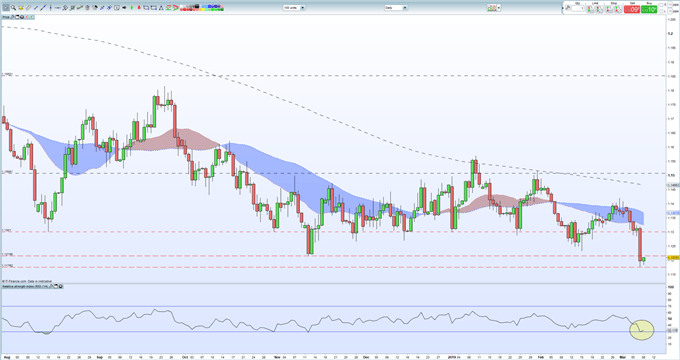

The daily EURUSD chart looks oversold in the short-term, using the RSI indicator, and the pair may nudge higher ahead of the US labor report. Market expectations are for 180k jobs to be added in February with average hourly earnings pushing 0.3% higher m/m.

However, the Euro remains weak and any better-than-expected US data at 13:30 could see the pair re-testing Thursday’s 21-month low at 1.1175.

EURUSD Technical Analysis: Sellers Try to Clear a Path Below 1.10.

EURUSD Daily Price Chart (August 2018 – March 8, 2019)

Retail traders are 70.6% net-long EURUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however give us a stronger bearish contrarian bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.