S&P 500 Outlook Talking Points:

- Another round of TLTROs from the ECB seemingly pressured the S&P 500 on Thursday, contributing to a fourth consecutive day of losses

- Non-farm payrolls and US unemployment will be released at 13:30 GMT, 8:30 AM EST Friday

- The data may leverage significant influence over US equities given their turbulence this week

See how IG clients are positioned on the Dow Jones, S&P 500 and the US Dollar with our free IG Client Sentiment Data.

S&P 500 Outlook: Unemployment Data to Lead Index Price

Yesterday I highlighted the potential impact of the ECB’s monetary policy meeting on the Dow Jones. With the resulting price action more bearish than anticipated, a risk-off mood remains dominant into Friday’s session. As the headline data, change in US non-farm payrolls and the unemployment rate will look to influence early equity performance as markets digest the data.

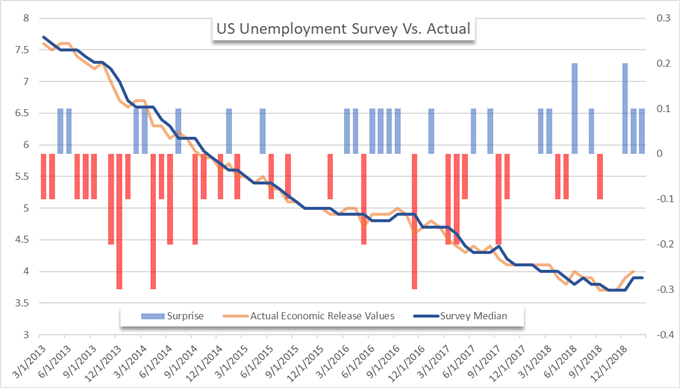

US Unemployment Rate (Chart 1)

With previous unemployment releases, sector sensitivity to data surprises seems to be somewhat random and often overshadowed by other themes. For example, the unemployment rate in December 2018 surprised markets with a 0.2% beat of survey expectations. Evidently, strong employment was unable to stem the tide from other market themes and sector performance was negative throughout. The recent string of positive data surprises also did little to encourage bullish price action.

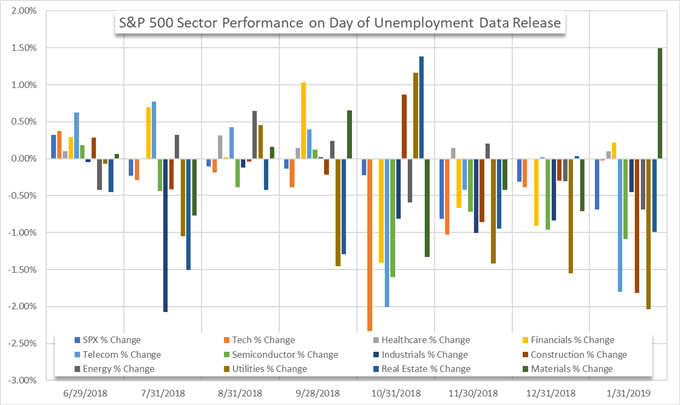

S&P 500 Sector Reaction to Unemployment Data (Chart 2)

With that said, the utilities sector appears to be one of the more volatile industries on days of the data’s release. Regardless of direction, the sector has been one of the top-3 biggest movers in 6 of the last 8 release sessions. Further, it notched the biggest move in 4 of the last 8. As Friday’s session approaches, it would be within reason to assume utilities will once again appear an outlier for market volatility.

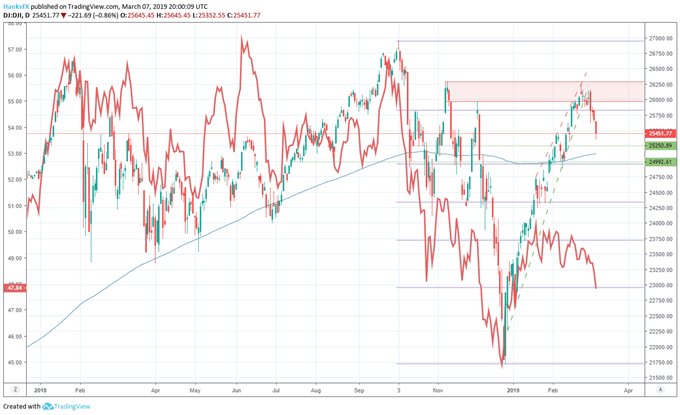

Dow Jones Price Chart: Daily Time Frame (January 2018 – March 2019) (Chart 3)

Dow Jones Price chart overlaid with ratio of SPX to XLU (Utilities ETF)

The sector has outperformed the broader S&P 500 since mid-February. Largely because the typically-defensive sector has enjoyed gains from the broader-market rebound while standing firm on red days like today.

Looking to take your trading to the next level? Check out our free Advanced Trading Guides.

According to a Twitter poll, traders are fairly split on tomorrow’s unemployment outcome, with a slight bearish leaning. Follow @PeterHanksFX to participate in the poll and for equity-leaning content. Given the turbulence in equities this week after failing to break through technical resistance, tomorrow’s data may spark considerable price action as traders grasp to find the next trend.

For other non-farm payroll trading opportunities, check out Pre-NFP Price Action Setups Across the US Dollar.Non-farm payrolls is one of the most market moving economic indicator for the US Dollar, learn to trade real-time news events like it with our Trade the News Trading Guide.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Stock Market Fund Inflows Return as S&P 500 Hits Technical Resistance

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.