IMPLIED VOLATILITY – TALKING POINTS

- Jobs data out of the United States and Canada set for release tomorrow looks to provide a fresh take on the economy in North America and could cause USDCAD to gyrate

- A persistently robust US jobs market could solidify recent EURUSD downside and even extend spot prices lower in response to further evidence of economic divergence

- New to currency trading? Take a look at the Forex for Beginners and Introduction to Forex News Trading educational guides by DailyFX to gain insight from our analysts

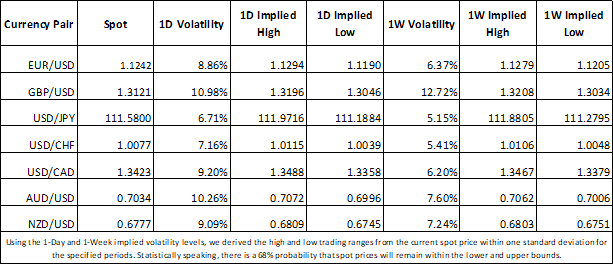

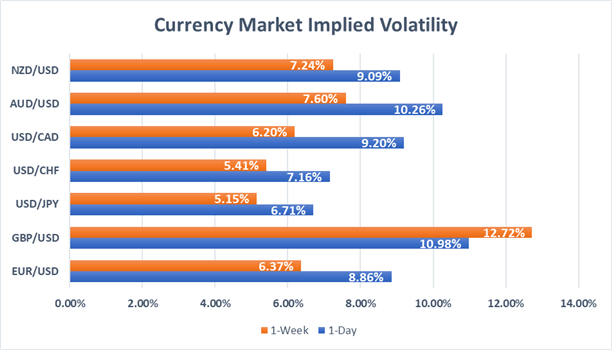

The last few days have been a wild ride for short-term currency traders as a barrage of global economic data releases and central banker commentary sent forex pairs swooning. In response, implied volatility has escalated throughout the week as the option market prices in higher anticipated price action.

CURRENCY MARKET IMPLIED VOLATILITY AND TRADING RANGES

Job reports out of the US and Canada scheduled for 13:30 GMT tomorrow should cap off this week’s market-moving data releases. In anticipation of the upcoming data, forex option traders have bid up USDCAD overnight implied volatility to its highest level since January 3. CAD traders already saw the currency tumble nearly 1 percent as dovish remarks from the Bank of Canada yesterday pushed the Loonie lower.

Although USDCAD 1-week implied volatility has faded from recent highs as previously estimated price action became realized, the currency pair could extend gains just as easily as it could reverse lower tomorrow with employment numbers likely weighing heavily on the cable’s next direction.

UPCOMING FOREX ECONOMIC DATA RELEASES AND EVENT RISK

Today’s EURUSD selloff in response to Mario Draghi and the European Central Bank lowering economic growth and inflation targets sent the currency pair to its lowest level since June 2017. The aftermath during tomorrow’s session could provide some relief from selling pressure if US data crosses the wires below expectations. Alternatively, a persistently robust American jobs market could solidify recent EURUSD downside and even extend spot prices lower in response to further divergence between the two economies.

---

Written by Rich Dvorak, Junior Analyst for DailyFX

Follow on Twitter @RichDvorakFX

Check out our Education Center for more information on Currency Forecasts and Trading Guides.

https://www.dailyfx.com/forex/market_alert/2019/03/06/USDCAD-Soars-After-Bank-of-Canada-Strikes-Dovish-Tone.html