MARKET DEVELOPMENT – GBP Rejects 1.32, USDCAD Eyes Range-break, EUR looks to ECB

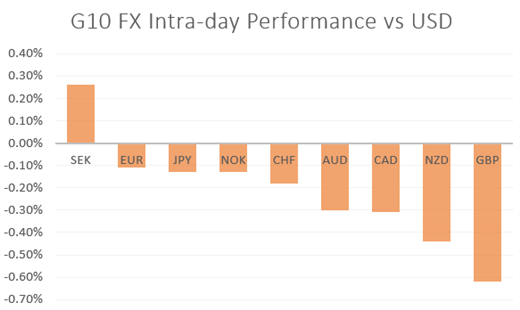

GBP: The Pound is the notable underperformer this morning with the currency taking a knock after UK government noted that the meeting between Attorney General Cox and EU’s Barnier was unlikely to result in a breakthrough. Consequently, this had exacerbated the pullback from the 1.32 handle with investors also taking profits. Elsewhere, UK Services PMI surprised to the upside, however, IHS Markit continued to note that growth in Q1 had flatlined.

AUD: Modest losses for the Aussie with investors now looking ahead towards RBA Lowe and Q4 GDP data. Overnight, the RBA left the cash rate unchanged at 1.5%, while the statement had be largely unchanged. Upside in AUDUSD likely to be capped by the sizeable option expiry at 0.7150, while support at 0.7050 continues to hold for. Given that risks are tilted to the downside for tonight’s GDP report, a miss on forecasts could see near-term support taken out.

EUR: Better than expected Eurozone PMI figures failed to brighten the fortunes for the Euro with many participants gearing up for Thursday’s ECB meeting, in which the central bank is expected to downgrade growth and inflation forecasts and may signal need for further stimulus measures. Subsequently, EURUSD remains on the backfoot.

CAD: The Loonie is trading at a 5-week low against the greenback with USDCAD back towards the top of its recent range. After reports that another minister had resigned from PM Trudeau’s cabinet, political uncertainty is beginning to weigh on the CAD. Alongside this, tensions between Canada and China are beginning to increase following China’s decision to block canola shipments from Canada’s Richardson. A closing break above 1.3175 sees a move towards 1.34.

Source: Thomson Reuters

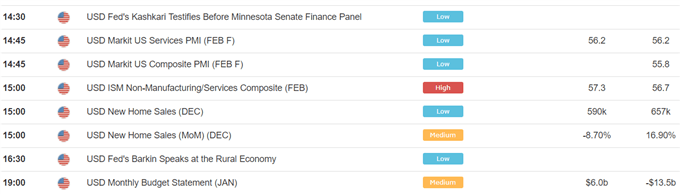

DailyFX Economic Calendar: – North American Releases

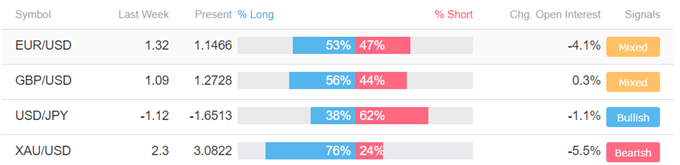

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “AUDUSD Outlook: Focus on Q4 GDP & RBA Governor Lowe Speech” by Justin McQueen, Market Analyst

- “Sterling Nudges Higher After PMIs, Brexit Continues to Dampen UK Growth” by Nick Cawley, Market Analyst

- “Technical Outlook for USD, USDCAD, AUDUSD, AUDJPY, Gold Price & More” by Paul Robinson, Market Analyst

- “EURUSD Price Analysis: Breaking Lower Ahead of ECB” by Martin Essex, MSTA , Analyst and Editor

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX