Australian Dollar, Caixin PMI Talking Points

- Australian Dollar falls after China Caixin services PMI missed expectations

- Data underscored need for stimulus as China, Nikkei 225 fell as mood soured

- AUD/USD could yet recover losses if the RBA disappoints dovish policy bets

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

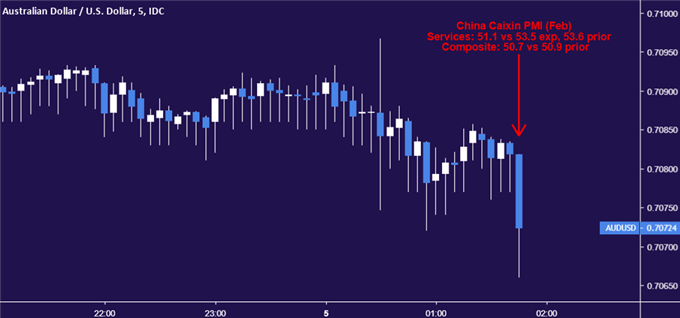

The Australian Dollar declined in morning Tuesday trade following softer-than-expected Chinese Caixin PMI data. Services data, the sector in which the world’s second-largest economy is slowly transitioning more into, clocked in at 51.1 in February versus 53.5 expected. That was the weakest pace of expansion (above 50 equals growth while below 50 means contraction) since October 2018. Composite PMI was 50.7 from 50.9 prior.

China is also Australia’s largest trading partner. Softer economic performance in the former could have adverse knock-on effects on the latter.

Risk trends were also souring, with the Nikkei 225 aiming lower on the announcement. China’s economy is slowing, and these numbers continue to show the need for economic stimulus. Speaking of which, a little over an hour before the Caixin PMI data was released, China announced that it will be cutting taxes as it lowered GDP estimates. AUD/USD could yet recover some of its gains over the next few hours.

Join me as I cover the RBA rate decision LIVE and the reaction in the Australian Dollar where I will also be looking at the risks for AUD/USD ahead!

That is because we could be in for a less-dovish RBA rate decision. The central bank is still quite patient on its approach for interest rates. While it sees its outlook as more neutral from favoring a hike now, it is in no rush to adjust its monetary-setting tool as is. Thus, with over half of the markets pricing in a cut by the end of this year, we may see some of those bets unwind. That may push AUD/USD higher. You may follow me on Twitter for the latest updates on the Aussie here at @ddubrovskyFX.

AUD/USD 5-Minute Chart Reaction to Caixin PMI Data

Chart Created in TradingView

Australian Dollar Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter