ECB Meeting, EURUSD Price and Chart:

- Euro is weak across a range of currencies.

- ECB meeting may offer further clues on liquidity.

Q1 2019 EUR Forecast and USD Top Trading Opportunities

The Euro continues to edge lower ahead of the latest ECB monetary policy meeting with President Mario Draghi likely to announce further liquidity measures to help boost growth and price pressures. All policy levers will be left untouched, but Draghi is likely to outline further details for a third round of TLTROs, targeted lending that the ECB hope will help to reinvigorate the economy. The single-currency remains downbeat despite slightly better-than-expected economic data, although the outlook for the Euro-Zone remains one of slowing growth and lower-than-forecast inflation. The ECB is likely to downgrade growth and inflation forecasts, and this is expected to leave the Euro vulnerable to further weakness.

The US dollar in contrast continues to push higher, supported by better-than-expected Q4 GDP figures and a Chicago Purchasing Manager reading that trounced expectations.

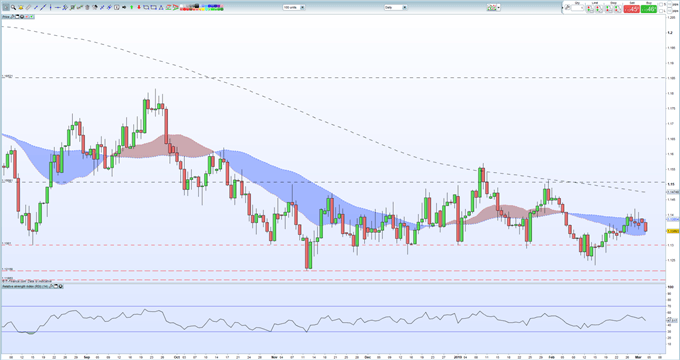

EURUSD is back at a one-week low and is nearing its20-day moving average, which may provide short-term support. Below here, we go back into the 1.1215 - 1.1300 zone which has proved resilient over the last few months and sparked buying interest. The RSI indicator remains mid-market and pointing lower.

DailyFX analyst Martin Essex will be covering the ECB Meeting Live on Thursday from 12;30 GMT.

EURUSD Daily Price Chart (August 2018 – March 4, 2019)

EURUSD Weekly Technical Forecast: Reversal, Price Pattern Point to Selling.

Retail traders are 53.2% net-long EURUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment - net-longs are 19.1% lower from last week - however suggest that EURUSD may soon reverse higher.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.