US Dollar, Jerome Powell Talking Points

- The US Dollar held onto gains after Fed Chair Jerome Powell spoke

- He reiterated much of what was said from his testimony to Congress

- DXY faces a breakout ahead to determine its next short-term path

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

The US Dollar, having already exerted most of its energy on better-than-expected GDP data, held on to its gains following another round of commentary from Fed Chair Jerome Powell. He reiterated much of what was already said in his testimony before Congress, such as the central bank’s patient ‘wait-and-see’ approach for rates. Mr Powell said that the US economy is ‘in a good place’ with inflation running close to 2%.

Additional Commentary from Fed Chair Jerome Powell

- US faces challenges including low productivity

- Upward inflation pressure muted despite strong job market

- Most incoming data solid, some sentiment surveys lower

- Unexpectedly weak December retail sales reason for caution

What is becoming increasingly certain is that the central bank is on a path to halting the runoff in its balance sheet. We even saw equities rise on last week’s FOMC meeting minutes because this path is more clear than the natural uncertainty of interest rates. Keep in mind that the domestic economic outlook is overshadowed by some ‘cross-currents’ such as slowing global growth.

US Dollar Technical Analysis

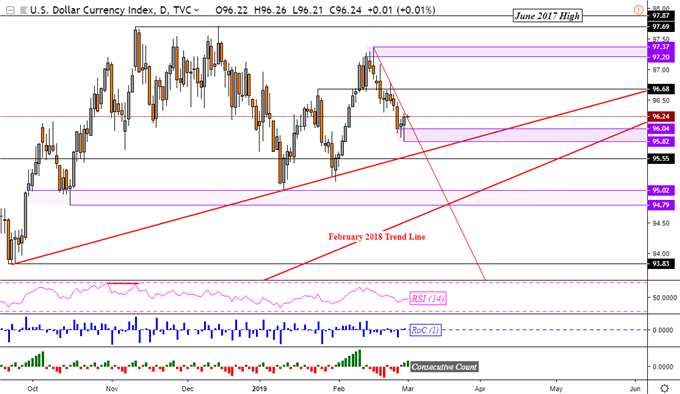

The US Dollar, after clocking in its best daily performance in over two weeks, finds itself sitting right on the descending resistance line from the middle of February. Meanwhile near-term support, a range between 95.82 and 96.04, was bolstered. As such, we may see a breakout soon that could pave the way for what is to come in the short-term. You may follow me on Twitter for the latest updates on the Greenback here at @ddubrovskyFX.

DXY Daily Chart

Chart Created in TradingView

US Dollar Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter