Gold (XAU) Price, News and Chart:

- Fed Chair Powell preaches patience.

- India and Pakistan raise political tensions.

Q1 2019 Gold Forecast and Top Trading Opportunities

Gold continues to consolidate above the $1,320/oz. level after its recent rally and may make a fresh attempt at the recent 10-month high at $1,347/oz. FOMC Chair Jerome Powell told lawmakers yesterday that the Fed is no rush to increase rates and reiterated the central bank’s ‘patient’ stance, pushing the greenback marginally lower. With US and global growth slowing, expectations are now growing that the Fed rate tightening cycle is now over, and interest rate cuts may be needed in 2020 to help boost growth and inflation.

Gold should also get an uplift from increasing political tensions between India and Pakistan over the disputed Kashmir region. On Tuesday, Indian planes flew into Pakistan airspace and bombed a terrorist camp, sparking conflict between the two nuclear powers. And today, Pakistan shot down two Indian Air Force planes inside Pakistan airspace and captured one Indian pilot in an act of retaliation that will provoke further actions from India.

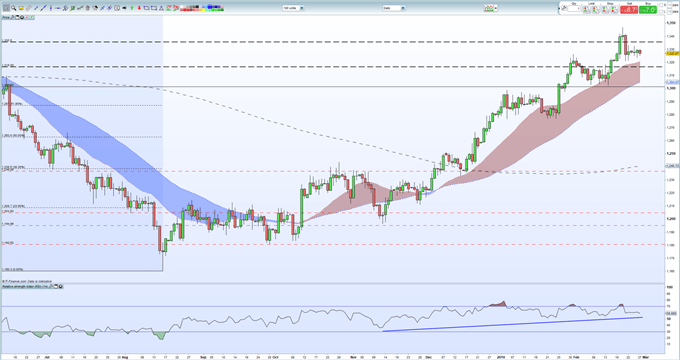

Gold has been trading sideways for the last handful of sessions, consolidating its recent rally. From a technical view, the precious metal trades above all three-moving averages and the RSI indicator has moved out of overbought territory but remains positive. Support starts around $1,320/oz. and includes a cluster of recent lows and the 20-day ma before the $1,302/oz. comes into play. Last Friday’s high just under $1,333/oz. is the initial target before $1,347/oz. comes into play.

How to Trade Gold – Top Strategies and Tips

Gold Daily Price Chart (June 2018 – February 27, 2019)

Retail traders are 69.7% net-long Gold according to the latest IC Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however give us a stronger bearish trading bias.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.