MARKET DEVELOPMENT – USD Dips, Oil Plunges, AUD & NZD Outperform, Trade War Deal Nears

Crude Oil: Brent and WTI crude futures fell over 2% after Trump stated that oil prices were getting too high and calling on for OPEC to relax. Brent now crude sub $66/bbl, having traded at 3-month highs. Consequently, oil exporters have seen a slight pullback against oil importers (Click here).

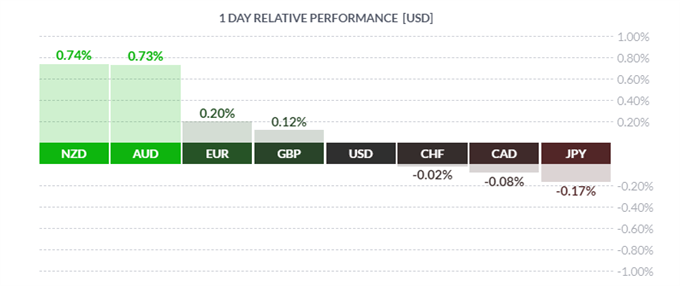

AUD / NZD: Both the Aussie and Kiwi gained on the back of comments by President Trump, in which he stated that he would delay the planned tariff increase on Chinese imports (Deadline March 1st) and that he will be looking to have summit with President Xi once an agreement can be reached. Consequently, antipodeans are outperforming across the board with AUD and NZD hitting highs of 0.7180 and 0.6900 respectively.

USD: The USD is softer across the board with the exception of the safe-haven JPY as an end to the US-China trade war looks to be drawing closer. Elsewhere, eyes will be on Fed Chair Powell, who is likely to reiterate patience with regard to rate rises.

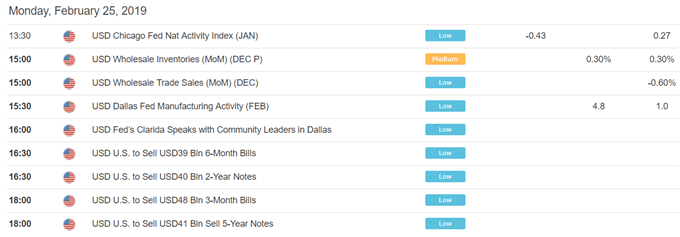

DailyFX Economic Calendar: – North American Releases

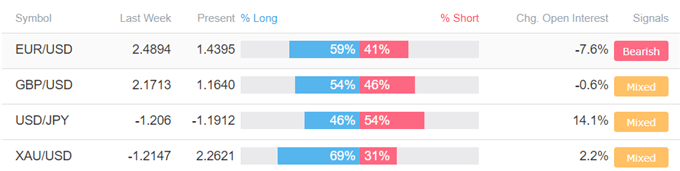

How to use IG Client Sentiment to Improve Your Trading

Four Things Traders are Reading

- “Crude Oil Drops After Trump Warns OPEC Again on High Oil Prices” by Justin McQueen, Market Analyst

- “Sterling (GBP): Brexit Vote Delayed, Can Kicked Again” by Nick Cawley, Market Analyst

- “S&P 500, Dow, and Nasdaq 100 Charts: Could Be an Important Week” by Paul Robinson, Market Analyst

- “AUDUSD & NZDUSD Lifted on Trade War Relief as Trump Offers Deadline Extension” by Justin McQueen, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX