AUD & NZDPrice Analysis and Talking Points:

- Trade War Relief Boosting Risk Appetite

- Strong NZ Data Also Underpins Kiwi, Eyes on RBNZ Speak

See our quarterly AUD forecast to learn what will drive prices throughout Q1!

Trade War Relief Boosting Risk Appetite

Both the Aussie and Kiwi gained on the back of comments by President Trump, in which he stated that he would delay the planned tariff increase on Chinese imports (Deadline March 1st) and that he will be looking to have summit with President Xi once an agreement can be reached. Consequently, antipodeans are outperforming across the board with AUD and NZD hitting highs of 0.7160 and 0.6883 respectively.

Strong NZ Data Also Underpins Kiwi, Eyes on RBNZ Speak

The Kiwi has also found support from strong NZ retail sales volume figures, whereby the headline figure surged 1.7%, which was a notable pick-up from the flat reading in the prior quarter. As such, this suggests that New Zealand’s economy at the backend of the year remained relatively strong, which in turn poses upside risks to Q4 GDP data. In turn, AUDNZD has edged back down towards 1.04. However, eyes are now set on RBNZ Deputy Governor Bascand, who is scheduled to speak at 2330GMT. As a reminder, Bascand last week opened up the possibility for the central bank to cut rates over proposals to increase bank capital requirements.

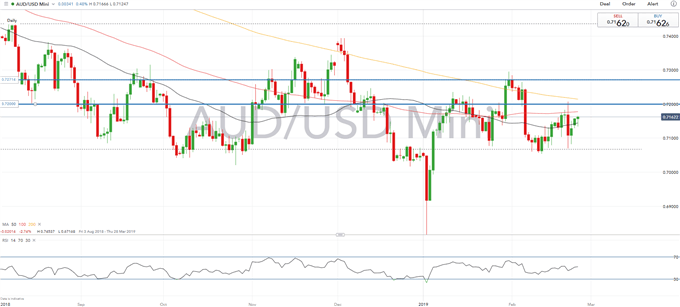

AUDUSD PRICE CHART: Daily Time-Frame (Dec 2017-Feb 2019)

AUDUSD edging towards the 0.72 handle, which could cap further upside for now. A closing break above however, leaves scope for a move to 0.7260-0.7270.

NZDUSD PRICE CHART: Daily Time-Frame (Aug 2018 – Feb 2019)

NZDUSD eyes a test of near-term topside resistance at 0.69, while the 2019 high at 0.6940 could also limit further gains.

FX TRADING RESOURCES:

- See our quarterly AUD forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX