EURUSD Price, Analysis and Chart:

- German car exports to the US could fall by 50%.

- Any additional trade tariffs would weigh on the Euro.

Q1 2019 Trading Forecasts including USD and EUR.

A recent report by the respected German Ifo Institute Center for Economic Studies posits that German car exports to the US could fall by 50% if America ‘were to impose permanent import duties of an additional 25%’. Ifo added that these tariffs would reduce German car exports by 7.7%, equivalent EUR18.4 billion. By Sunday, February 17, the US Department of Commerce will present a report on whether the high level of EU car imports into the US pose a threat to US national security, which may open the way for a new round of punitive tariffs. Ifo added that the EU may impose tariffs of US products to bring the economic effects of tariffs to ‘roughly zero’ although any trade war escalation will hurt both countries.

German automobile manufacturers, including giants Daimler and Volkswagen (VW), have both seen their share price fall by 25%-30% over the last 18 months due to a diesel scandal that has rocked the industry. Back in September 2015, the US Environmental Protection Agency accused VW of fitting illegal monitoring systems to its cars to manipulate emission readings.

This weekend’s ruling comes at a bad time for Germany and the EU with data showing German Q4 growth flat q/q while the EU grew by a miserly 0.2% in the same reporting period.

EURUSD Price Falls Further as Germany Narrowly Avoids Recession

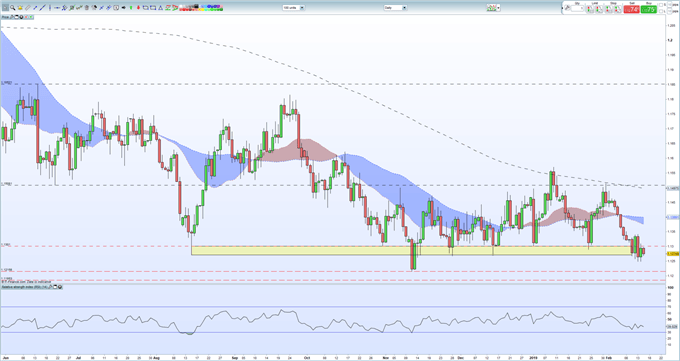

EURUSD is now battling to make a clean break and close back above 1.1300, an area that has acted as support over the past few months. To the downside, Wednesday’s low at 1.1248 was re-tested and rejected, just, on Thursday and may fall if the US look to impose tariffs. While the pair are nearing oversold territory, there is still room to fall further, while all three moving averages block any attempt to regain the 1.1500 level.

EURUSD Price Action Not Convincing, Further Downside Likely

IG Client Sentiment data currently shows retail are 70.6% net-long EURUSD, a bearish contrarian indicator. However, the combination of current sentiment and recent changes gives us a stronger bearish EURUSD trading bias.

EURUSD Daily Price Chart (June 2018 – February 15, 2019)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.