MARKET DEVELOPMENT –USD Drops, Germany Avoids Recession, GBP Looks to Brexit Vote

GBP: The Pound has been offered throughout the European morning. Reports that the Eurosceptic ERG will abstain and not back the government saw GBPUSD break below support at 1.2830 to test 1.28, which currently holds. However, while the UK government may lose in tonight’s Brexit vote, this is unlikely to have great ramifications for the Brexit process with the greater attention being placed on the vote at the end of the month (Feb 27th)

EUR: Quiet trading in EURUSD with the pair flat for the session. Germany narrowly avoided a technical recession, while Eurozone GDP figures printed in-line with analyst estimates. EURGBP has also continued to edge towards the 0.88 handle. However, with little buying interest above 0.88, potential for rallies to be faded.

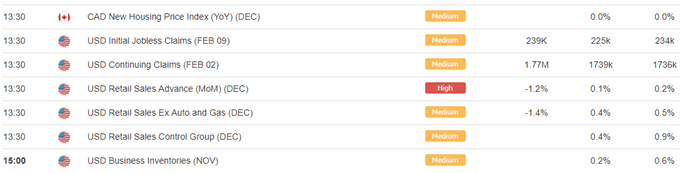

USD: The US Dollar dropped against its major counterparts following the weakest retail sales data in 9-yrs. Alongside this, jobless claims also picked up providing a further weight for the USD. Given that the Fed are much more data dependent than last year following their change in guidance to patience, negative data prints will carry more weight for the greenback.

AUD / NZD: Further trade war optimism continues to support high beta currencies (AUD, NZD) with the latest newsflow suggesting that the March 1st deadline could be extended by 60 days. As such, AUD and NZD are outperforming in the G10 space, more so for NZD on cross related selling through AUDNZD, which currently tests key support at 1.04.

DailyFX Economic Calendar: – North American Releases

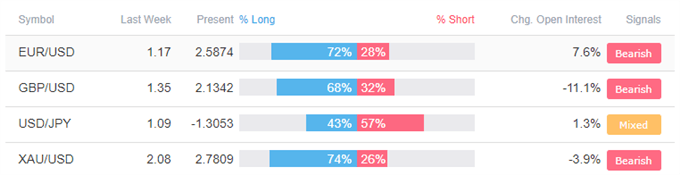

How to use IG Client Sentiment to Improve Your Trading

Four Things Traders are Reading

- “Key Charts to Watch: Default Buying in USD” by Justin McQueen, Market Analyst

- “Brexit News: Sterling (GBP) Eyes Latest House of Commons Clash” by Nick Cawley, Market Analyst

- “AUDNZD Looking to Extend Breakdown Below Support” by Paul Robinson, Market Analyst

- “Eurozone GDP Growth Slows, Euro Still Under Downward Pressure” by Martin Essex, MSTA, Analyst and Editor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX