Asian Stocks Talking Points:

- Markets were mixed as Chinese stocks returned from their long holiday, Japan had one of its own

- The US Dollar scored haven gains against the Euro and Australian Dollar

- Trade headlines from Beijing are likely to drive this week

Find out what retail foreign exchange investors make of your favorite currency’s chances right now at the DailyFX Sentiment Page

The new trading week got off to a mixed start Monday with trade concerns still very much to the fore.

There was disappointment Friday when it seemed unlikely that US President Donald Trump would meet his Chinese counterpart Xi Jinping after all, but investors are now looking to high-level talks which are set to continue in Beijing this week.

Chinese stock markets had been out for most of last week thanks to the long Lunar New Year break. They returned with modest gains for Shanghai and Shenzhen. The Hang Seng inched higher. The region lacked Japanese participation as markets there were closed for a holiday. The ASX 200 managed to rise, while South Korea’s Kospi was in the red as its close approached.

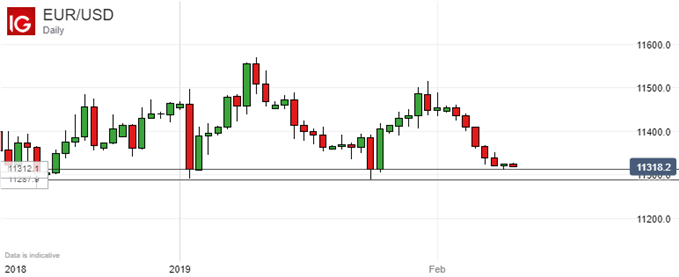

The US Dollar attracted something of a haven bid in the face of trade worries, with the likes of the Australian Dollar and the Euro under pressure. EUR/USD is again approaching its lows for the year, struck last in late January.

However, support has been solid in this region since mid-November so the uncommitted may want to see whether it can survive another test before stepping into the market.

Crude oil prices slipped on news of an increase in operational US drilling rigs, while gold prices were a little steadier.

Monday’s remaining data slate includes a plethora of important UK numbers, including the official Gross Domestic Product release. Central bank watchers will await the European Central Bank’s Vice President Luis De Guindos. He is due to speak in Madrid.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!