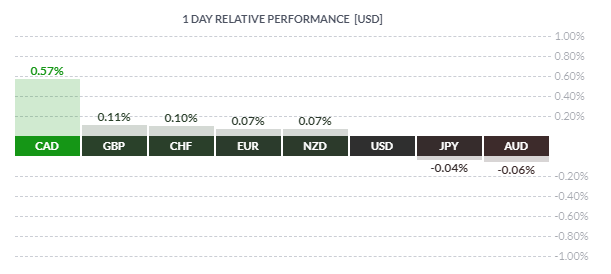

MARKET DEVELOPMENT – CAD Soars, AUD Bears Remain, EUR Looks to EU-US Trade War

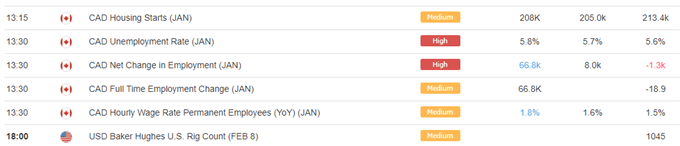

CAD: Canadian Dollar surges as today’s strong jobs report dominates. Employment change surged by 66.8k against forecasts of 8k. While unemployment rate rose above consensus, this can partially be attributed to the pick up in the participation rate. What is perhaps more positive is the fact that wage growth picked up for a second consecutive month, now at 1.8% from 1.5%, which will likely please the BoC. (CAD Technicals, click here)

EUR: With the Euro being offered throughout the week amid the wave of soft data from the Eurozone yet again. However, slight position squaring ahead of the weekend has eased some of the downside for now, while the key 1.13 also elicits support. Elsewhere, a report from German press brought the EU-US auto tariffs back into focus with the report highlighting that a 25% tariff remains on the table. This comes ahead of next weeks deadline (Feb 17-19th) where the Department of Commerce will conclude their investigation into Section 232.

AUD: Realisation sinking for the RBA who are beginning to signal concerns over housing market and its implications. However, while forecasts had been downgraded the view from the RBA that 3% growth could be achieved may be somewhat optimistic. As we noted a cut is a more likely with markets also taking this viewpoint, consequently, growth may see further downgrades later this year. Alongside this, reports yesterday that President Trump and Xi are unlikely to meet before the negotiating deadline (Mar 1st) provides another bearish factor for the AUD.

DailyFX Economic Calendar: – North American Releases

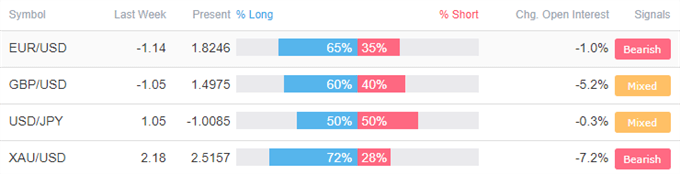

How to use IG Client Sentiment to Improve Your Trading

Four Things Traders are Reading

- “Charts for Next Week: EUR/USD, USD/CAD, AUD/USD & More” by Paul Robinson, Market Analyst

- “EURUSD Price: Nearing a Strong Support Zone” by Nick Cawley, Market Analyst

- “CAD Technical Analysis Overview: USDCAD, EURCAD, CADJPY” by Justin McQueen, Market Analyst

- “Brexit and the Pound: Why EU Might Spurn a Last-Minute Deal With the UK” by Martin Essex, MSTA , Analyst and Editor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX