EURUSD Price, Analysis and Chart:

- German Factory Orders weak, but not as weak as the headlines.

- Fears over the Italian debt pile continue to weigh on the Euro.

Q1 2019 Trading Forecasts including USD and EUR.

EURUSD – Six Daily ‘Lower Highs’ in a Row

EURUSD currently changes hands around 1.13850, the lowest level in 10-days as more weak economic data fuels fears over the health of the Euro-Zone economy. The latest German Factory Orders (y/y) contracted by 7% - although last month’s negative figure was revised higher – continuing a trend of under-par economic data releases from the single-block. German 2019 growth has already been downgraded to 1% from 1.8%, while recent PMI data showed Euro Zone growth nearing stagnation.

Italian government continue to collect headlines with fears growing that the country’s debt pile will weigh further. A report in Reuters showed that EUR425 billion of the country’s EUR1.5 trillion of debtis held by French, German and Spanish banks. Any further bond sell-off/rise in yields could fuel fears of a further balance sheet pressure for an already weak European banking sector. Recent ECB talk suggests a new batch of cheap loans for European banks (TLTROs) have been discussed by the central bank recently in a fresh attempt to increase liquidity into the banking system.

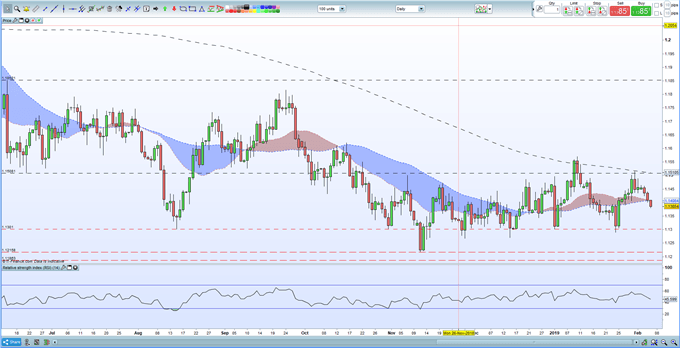

EURUSD is back below 1.1400 and has formed six daily ‘lower high’ candles in a row, highlighting the market’s bearish sentiment. The 1.1500 level has proved stubborn resistance for the pair recent ly due to a confluence of old swing lows and the 200-day moving average. EURUSD is also below its 20- and 50-day moving averages, while the RSI indicator is pointing lower. There are no real support levels all the way down to the 1.1300 area, a level that has proved difficult to fully break so far.

IG Client Sentiment data currently shows retail are 53.4% net-long EURUSD, a bearish contrarian indicator. In addition, traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD bearish contrarian trading bias.

EURUSD Daily Price Chart (July 2018 – February 6, 2019)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.