EURUSD Analysis and Talking Points

- EURUSD Lacks Bullish Impetus from Subdued Eurozone Data

- Don’t Bank on Range-Break According to Option Markets

- ECB to Affirm Cautious View

DailyFX Q1 2019 Trading Forecasts for EURUSD

EURUSD Lacks Bullish Impetus from Subdued Eurozone Data

Despite the slightly better than expected Eurozone services and composite PMI figures, the Euro remains in limbo, with the subdued readings unlikely to ease fears over a slowdown within the Eurozone. IHS Markit noted that the PMI indicates that GDP is growing at quarterly rate of 0.1%, which mark the worst reading since 2013. Consequently, with upside risks somewhat limited, there is little signs to suggest that the EURUSD range that has been intact for the past 4-months is set to break in the near term. Elsewhere, 1.1bln worth of vanilla option expiries at 1.1400-10 (noted here) may attract in quiet conditions.

Don’t Bank on Range-Break According to Option Markets

Both 1-week and 1-month implied volatility has dropped to the lowest level in over a year. While risk reversals have moved closer to neutral with recent sessions seeing premium for puts (downside protection) paired. Subsequently, suggesting that EURUSD may continue to be somewhat directionless in the short term with the 1.12-1.16 range to remain intact.

ECB to Affirm Cautious View

Given the indications that Eurozone GDP is growing at its weakest rate since the Eurozone debt crisis, this will likely affirm the ECB’s cautious stance, with growth forecasts being cut at the March meeting. Alongside this, the ECB may be forced to provide fresh dovish signals, potentially in the form of new TLTROs. As it stands, markets are currently pricing in a 46% likelihood that the ECB could raise the depo rate. However, given the continued uncertainty regarding the global outlook, risks are for a rate hike to be pushed out to Q1 2020.

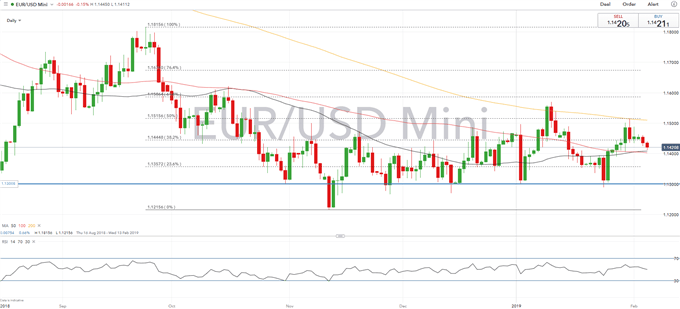

EURUSD Price Chart: Daily Time Frame (Aug 2018 – Feb 2019)

While EURUSD remains in limbo, downside support is seen at the 23.6% Fibonacci retracement (1.1357), a break below opens up for a test of key support at the 1.1300 figure. Euro bulls on the other hand would need to see a closing break above 1.1570 (Jan 10th high) to allow for a move towards 1.1650.

KEY TRADING RESOURCES:

- Euro: What Every Trader Needs to Know Just getting started?

- See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX