AUD/JPY TALKING POINTS – AUSTRALIAN DOLLAR, RBA, TRADE WAR NEWS

- AUD/JPY trending higher from positive trade war news?

- Markets are eyeing the US-China trade war negotiations

- Australian Dollar in focus as RBA delivers rate decision

See our free guide to learn how to use economic news in your trading strategy !

Australian Dollar traders will be closely watching the RBA’s Cash Rate Target decision at 03:30 GMT. Concerns over slower growth and comments from officials indicate a continuation of a cautious and dovish approach to policy. Uncertainty over the trade wars and China’s economy have been a key source of concern.

Click here to see the live webinar on the RBA rate decision and the market response !

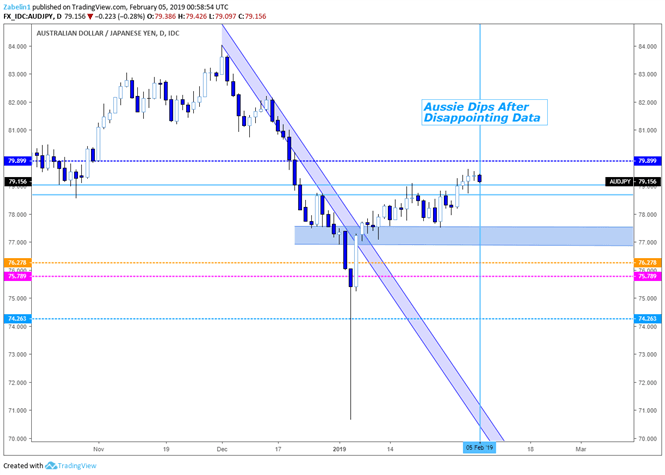

AUD/JPY has been trending higher since breaking through the December resistance and has gained over two percent. This might be a reflection of investor’s optimism over the outcome of the US-China trade talks following the Chinese Vice Premier’s visit to Washington last week. Washington and Beijing have until March 1 to reach an agreement before tariffs (up to 25 percent) are imposed on Chinese goods.

Slower growth in China and signs of weakness in the private sector has weighed on the Aussie and likely re-enforced the RBA’s dovish stance. This comes after reports from the beginning of this month – particularly in Building Approvals and Retail Sales – substantially fell short of expectations and sent AUD down. This only accentuates the broader downtrend AUD/JPY has been on since the start of last year.

AUD/JPY – Daily Chart

The pair may start looking to retest the 78.691-79.055 range as investors turn defensive amid the sour economic news. Traders will now likely be closely watching for comments from RBA officials and eyeing the developments between Beijing and Washington as the two economic superpowers race against the clock.

AUD/JPY TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter