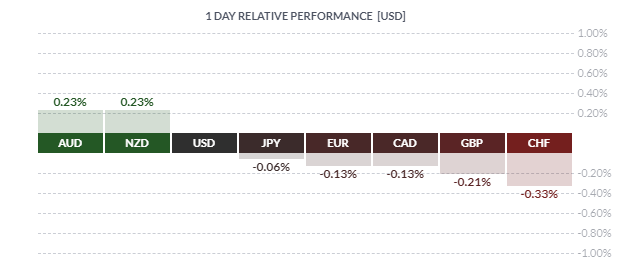

MARKET DEVELOPMENT – AUD Outperforms, Hat-Trick of Soft PMI Figures Dents GBPUSD

GBP: Hat-trick of weak UK PMI surveys (Manufacturing, Construction and Services) sees GBPUSD make a decisive break below the 200DMA, consequently, sparking a test of the 1.3000 to the downside, which has held firm for now. IHS Markit highlighted that Q4 GDP may have eked out a meagre gain of 0.1%. Elsewhere, on the Brexit front, PM May will meet Juncker in Brussels on Thursday, as such, headline risk will be elevated.

EUR: Despite the slightly better than expected Eurozone services and composite PMI figures, the Euro remains in limbo, with the subdued readings unlikely to ease fears over a slowdown within the Eurozone. IHS Markit noted that the PMI indicates that GDP is growing at quarterly rate of 0.1%, which mark the worst reading since 2013. Consequently, with upside risks somewhat limited, there is little signs to suggest that the EURUSD range that has been intact for the past 4-months is set to break in the near term. Elsewhere, 1.1bln worth of vanilla option expiries at 1.1400-10 (noted here) may attract in quiet conditions.

AUD: The Australian Dollar is among the best performers this morning following the RBA’s statement. As we highlighted yesterday, those expected a dovish RBA had been disappointed with the central bank a relatively optimistic outlook, particularly on the labour market and thus reducing the likelihood that their rate guidance will be shifted for now. AUDUSD is currently hovering around the 0.7250, eyes will now turn towards RBA Governor Lowe’s comments later tonight, before the Statement on Monetary Policy on Friday. Resistance situated at the 200DMA (0.7290).

DailyFX Economic Calendar: – North American Releases

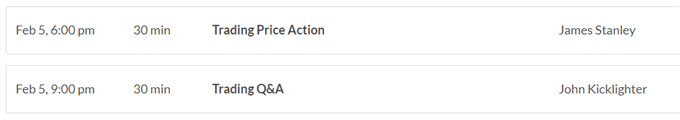

Send your questions into Chief Currency Strategist, John Kicklighter, Click Here

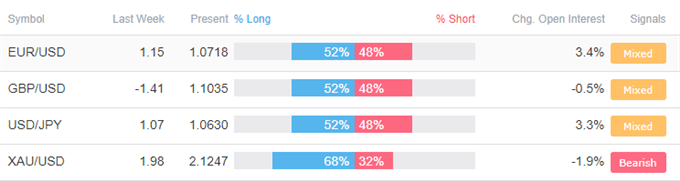

How to use IG Client Sentiment to Improve Your Trading

Four Things Traders are Reading

- “Technical Analysis for EUR/USD, USD/CAD, AUD/NZD & More” by Paul Robinson, Market Analyst

- “Brexit Latest: Chancellor Merkel’s Optimistic Talk on Irish Backstop” by Nick Cawley, Market Analyst

- “EURUSD Price Analysis: Lack of Bullish Impetus Limits Near-Term Range-Break” by Justin McQueen, Market Analyst

- “Crude Oil Price Outlook: Rising on Positive Fundamentals & Technicals” by Martin Essex, MSTA , Analyst and Editor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX