TALKING POINTS – AUD/USD, RBA, CHINA, TRADE WARS, STOCKS, US CPI

- Australian Dollar gained against the greenback after the RBA maintained its OCR

- AUD/USD continues to trend higher,prices testing support levels at 0.7161-0.7234

- US-China trade talks, stock benchmarks, and US inflation data in the spotlight

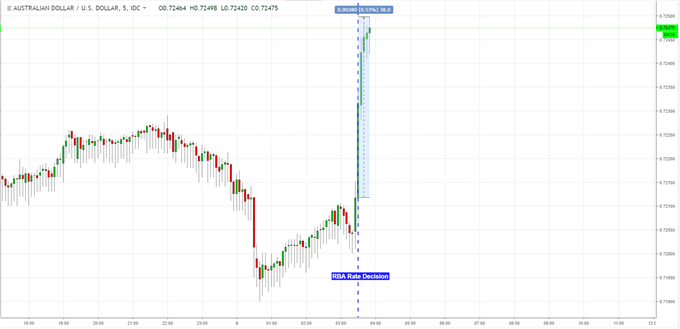

The Australian Dollar soared against its US counterpart after the Reserve Bank of Australia’s rate decision crossed wires during Tuesday’s Asia Pacific trading session. As expected, the monetary policy authority left its overnight cash rate unchanged at 1.50% and avoided an increasingly dovish shift. The central bank stated that it sees gradual inflation pick up over the next couple of years, and that it will take a little longer than earlier seen. It also added that trade tensions are affecting global trade while noting slowing Chinese economic growth.

AUD/USD Chart (5-minute)

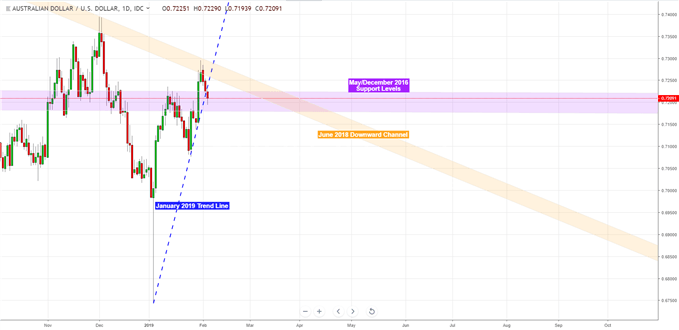

AUD/USD’s rally may continue. Despite breaching an ascending trend line from January 2019, prices have been trending higher for the majority of this year. Currently, the pair is testing support levels last seen in May and December 2016 near the 0.7161-0.234 figures. From here, a break above this range and the June 2018 downtrend channel confirmed on a daily closing basis could lead to further bullish price action.

AUD/USD Chart (Daily)

Looking ahead, the currency pair will closely eye developments in ongoing trade negotiations between the United States and China. Continued investor optimism and progress in these talks could lead to gains for the Aussie. Risk trends will also dominate next moves for the pro-risk AUD, in addition to the release of January’s US consumer inflation figures next week.

AUD/USD Trading Resources

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners' guide for FX traders

- Having trouble with your strategy? Here's the #1 mistake that traders make

- See how the Australian Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Megha Torpunuri, DailyFX Research Team