TALKING POINTS - AUD/USD, CHINA CAIXIN PMI, TRADE WARS

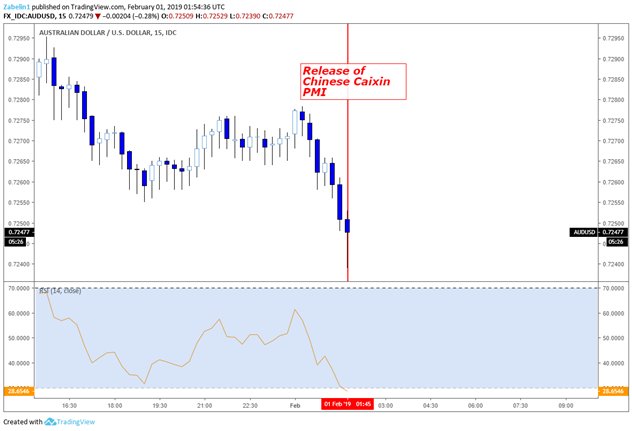

- China’s PMI Caixin Index undershot forecasts

- AUD/USD, Australian 2-year bond yields fall

- Markets now eyeing trade talks in Washington

See our free guide to learn how to use economic news in your trading strategy !

AUD/USD, along with Australian 2-year bond yields and the country’s benchmark ASX equity index fell after China’s Caixin PMI underwhelmed. Forecasts were at 49.6 with the actual at 48.3, the fastest contraction since 2016. Technical indicators were also signaling that the ASX was struggling to make upward progress with underlying momentum gradually declining.

AUD/USD – 15-Minute Chart

This week, the Chinese Vice Premier Liu He has been negotiating with the US Trade Representative Robert Lighthizer. Both Beijing and Washington are eager to reach an agreement to end the trade war before the deadline on March 1. If a deal is not reached by then, the US has threatened to impose tariffs up to 25 percent on $200 billion worth of Chinese goods.

So far, the biggest sticking points have been issues relating to tech intellectual property. This comes against the backdrop of the Huawei scandal and the arrest of its CFO Meng Wanzhou which has weighed on the trade negotiations. Despite this, Lighthizer and Mnuchin are flying to meet in with officials in China, possibly in mid-February.

Looking ahead, Reserve Bank of Australia will be announcing its Cash Rate Target on February 2 at 03:30 GMT. Given today’s disappointing data and China’s slowing economy, a rate hike in the near future is not likely. Other variations of Chinese PMI data will also be released which may move the Aussie. Slower growth in China and potential 2019 headwinds may weigh down on the Aussie as 2019 develops.

AUD/USD TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter