TALKING POINTS – China, GDP, INDUSTRIAL PRODUCTION, RETAIL SALES, TRADE WAR

- Australian Dollar rose after a cascade of Chinese data

- Chinese economic indicators were better than forecasted

- AUD/USD still likely to face uphill battle throughout 2019

See our free guide to learn how to use economic news in your trading strategy !

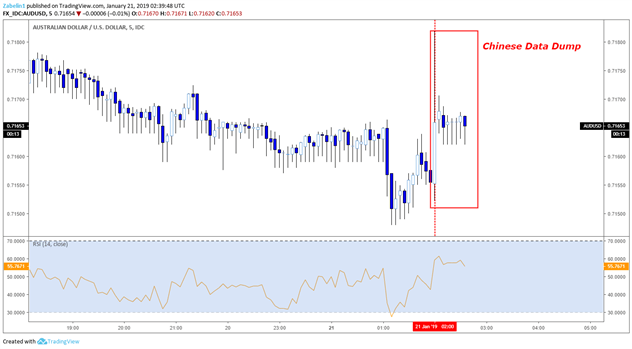

AUD/USD along with Australian 2-year bond yields rose after Chinese industrial production data exceeded expectations, coming in at 5.7% year-on-year compared with 5.3% forecasted. Retail sales also outperformed with 8.2% growth, outpacing the 8.1% forecast. Year-on-year and quarter-on-quarter measures of GDP growth eased lower in line with analysts' consensus projections to 6.4% and 1.5%, respectively.

AUD/USD – 5-Minute Chart

The Aussie’s jump could be attributed to the fact that traders may have been expecting even worse results than forecasters suggested. This in large part would likely have to do with the trade war between China and the US, which investors might have been expecting to have had a bigger negative impact.

Looking ahead, the Australian Dollar still must face a potential hurricane of headwinds in 2019, particularly on the trade war front. Negotiations between Beijing and Washington may have hit a snag around concerns of intellectual property, a key issue for the Trump administration.

As a cycle sensitive currency, the Australian Dollar is vulnerable to changes in conditions for global growth. The upcoming World Economic Forum in Davos, Switzerland, may be a key event that traders are monitoring to gauge the level of optimism – or pessimism – experts have on global growth in 2019.

AUD/USD TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter