Talking Points:

- US stocks are hitting fresh highs on more positive developments over the US-China trade war

- Strong manufacturing data puts US equity and dollar bulls in a good mood

- University of Michigan Consumer Sentiment drops to lowest level since November 2016

The US stock market gapped up around half a percent this morning as American equities carry over positive momentum from the Asian and European trading sessions. Price action comes on the back of yesterday’s headline that the White House was contemplating a reduction in tariffs on Chinese trade only to be contradicted by a Treasury Department spokesperson which initially caused stocks to gyrate.

Now, fresh news is just coming out that China may offer a path to eliminate the trade imbalance with the United States sending stocks soaring to intraday highs. Sources are now saying that China is offering a 6-year planned import boost to sweeten the pot for a trade deal. Risk assets that benefit from positive Trade War developments like the Dow Jones is celebrating on the news.

US DOW JONES INDEX PRICE CHART: 5-MINUTE TIMEFRAME (JANUARY 17, 2019 TO JANUARY 18, 2019) (CHART 1)

Stocks were already doing well in early trading as strong US Manufacturing Data casted a shadow over weaker than expected Consumer Sentiment. Manufacturing Production notched a 1.1% increase for December, far surpassing expectations of a modest 0.3% rise.

On the other hand, University of Michigan’s Consumer Sentiment Survey for January plummeted to 90.7 which is the lowest in 27 months as a whirlwind of risks ranging last month’s stock selloff, the US Government Shutdown and Brexit just to name a few lurk in the back of consumers’ minds.

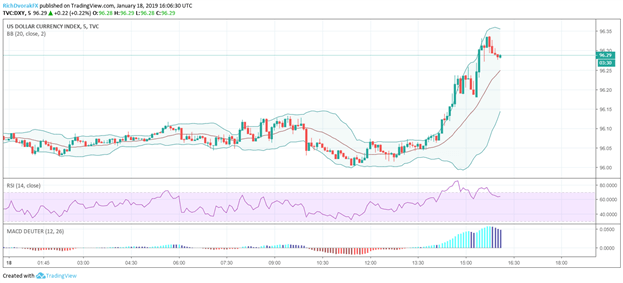

Although, this was quickly cast aside after the positive developments on the US-China trade war front. The US Dollar Index was also gaining ground from the positive hard economic data and trade war headlines this morning.

DXY INDEX PRICE CHART: 5-MINUTE TIMEFRAME (JANUARY 18, 2019 INTRADAY) (CHART 2)

---

Written by Rich Dvorak, Junior Analyst for DailyFX

Follow on Twitter @RichDvorakFX

Check out our Education Center for more information on Currency Forecasts and Trading Guides.