US Credit Rating Talking Points:

- Fitch rating agency issued a warning to the United States that a prolonged government shutdown could adversely impact its credit rating

- The warning comes as the shutdown looks to enter its 20th day with no clear resolution in sight

- Should Fitch issue the cut United States, it would be the second time a major rating agency downgraded the United States

A day after President Trump and Democrat leaders were deadlocked in an address to the nation, Fitch Ratings has issued a warning that would impact both parties. On Wednesday, the rating agency warned of a possible cut to the US ‘AAA’ sovereign credit rating later this year should the government shutdown continue. As the current shutdown threatens to become the longest ever, a credit cut could have a serious long-term impact.

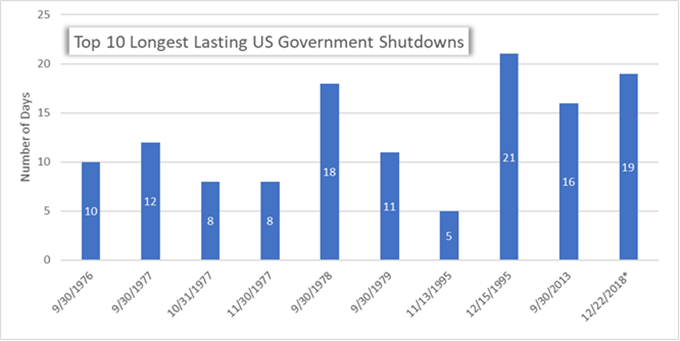

Longest Government Shutdowns (Chart 1)

Fitch’s global head of sovereign ratings, James McCormack said Wednesday “If this shutdown continues to March 1 and the debt ceiling becomes a problem several months later, we may need to start thinking about the policy framework, the inability to pass a budget ... and whether all of that is consistent with triple-A.” He continued, “from a rating point of view it is the debt ceiling that is problematic.” Such a downgrade would not be the first for the United States.

On August 5th, 2011 another major rating agency, Standard & Poor’s, downgraded the United States’ credit from its pristine standing. The cut from ‘AAA’ to ‘AA+’ was the first time the government was given a grade below perfect. Further, it occurred four days after the 112th United States Congress voted to raise the debt ceiling using the Budget Control Act of 2011. The downgrade came after warnings and a ‘negative outlook’ issuance from the agency in April 2011.

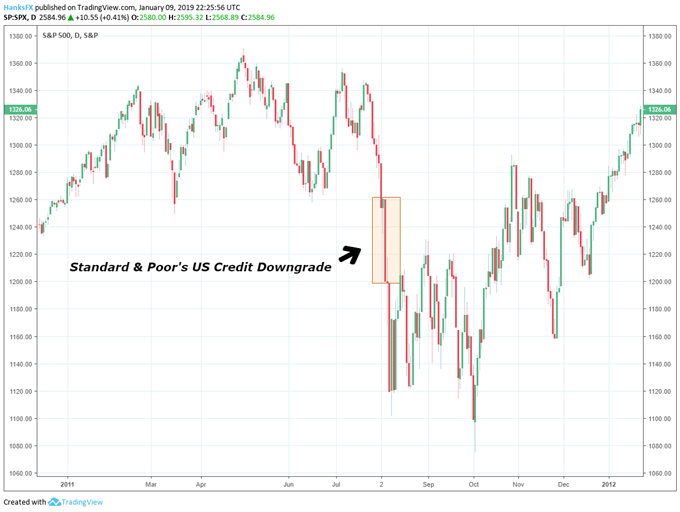

S&P 500 Price Chart Daily Timeframe, 2011 – 2012 (Chart 2)

According to Standard & Poor’s, the downgrade was issued because a government budget deficit of more than 11% of GDP and net-government debt rising to 80% of GDP by 2013 was too high relative to other ‘AAA’ rated countries. Subsequently, the S&P 500 dipped roughly 5%.

Already on unstable ground, a rating cut could spell disaster for equity markets. While the immediate impact on the United States may be minimal, the longer-term implications would only build over time. Like with any borrower, a poor credit score constitutes higher borrowing costs. Given the $21 trillion in debt owed by the United States, higher borrowing costs would severely compound the cost of future payments and thus further erode confidence in the United States ability to repay debt.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Will the Stock Market Crash in 2019?

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.