Sterling and Brexit Latest

- EU says no negotiation on current Brexit deal.

- UK Brexit secretary Barclay says no intention to delay Brexit.

See how our Q1 2019 Trading Forecast for GBP can help you when trading.

Learn from our Mistakes!!!- Here are some of the top lessons DailyFX analysts learned, absorbed or suffered from personal experience in 2018.

Sterling Starts to Lose Ground as PM May Stuck Between a Rock and a Hard Place

With one week to go before UK PM Theresa May’s bill goes before the House to be voted on, the EU has reiterated that the current offer is final and will not be amended, despite PM May seeking further amendments to the bill. Unless there are further amendments, especially on the Irish backstop, PM May is likely to be defeated in the vote, leaving a no deal/WTO rules Brexit a very real possibility.

According to European Commission spokesman Margaritis Schinas, the current Brexit deal on the table is the best and only deal possible. Mr. Schinas said that ‘there is no negotiation because everything on the table has been established as approved, established, achieved.’ He said that the priority now is to await events, adding that there will not be any meetings between the two sides negotiating teams.

According to UK Brexit secretary Baker, the government has no intention delating Brexit and that they would have ‘real difficulties’ with extending the Article 50 exit process. This statement came after various media reports surfaced suggesting that PM May would seek to push back Brexit in order for her to push her deal through Parliament.

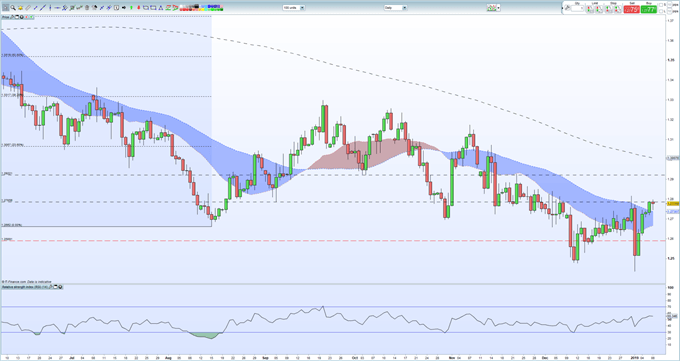

Sterling has edged lower against a mildly stronger US dollar and may fall further as Brexit twists and turns continue. The recent one-month high at 1.2814 is the first level of resistance and needs to be closed above to let Sterling move higher with the 1.3000-1.3050 area containing the 200-day moving average and the 23.6% Fibonacci retracement. On the downside, 1.2738 and 1.2667 – the 20- and 50-day moving averages – currently remain in place.

GBPUSD Technical Outlook: 20-Month Spike Low May be Re-Tested

GBPUSD Daily Price Chart (June – January 8, 2019)

If you are interested in trading, or just curious about how and why market moves occur, we have recently produced a new guide – How to Start Trading: Top Tips and Guides for Beginners – to help you start your journey.

IG Client Retail data confirms a negative picture for the GBPUSD. Retail are 53.8% net-long the pair, a bearish contrarian indicator. However, recent daily and weekly positional changes suggest that the pair may move higher.

What is your view on Brexit – bullish, bearish or bored?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.