Talking Points:

- Strong gains in the job market look to bolster risk assets

- Unemployment rate rises marginally to 3.9 percent

The US labor market shows off its resilience in December after adding 312,000 jobs, largely beating expectations of 180,000 additions. The data release looks to bolster risk assets with the US Dollar and S&P500 futures both gaining at a time investor sentiment remains subdued at deplorably low levels. Stocks are up over 1 percent in premarket trading with USD/JPY gaining back ground after the currency pair's flash crash on Wednesday.

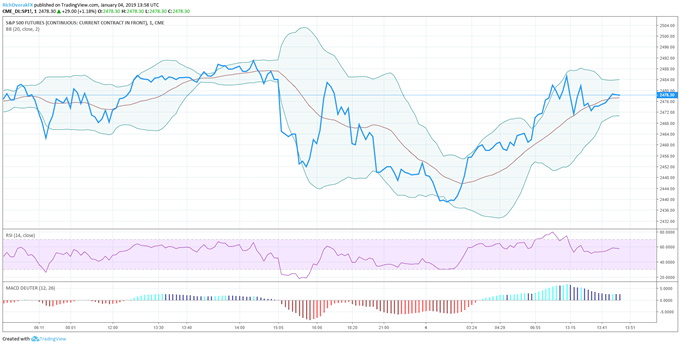

Price Chart of S&P500 Index Futures (1 Minute, January 4)

Price Chart of USD/JPY (5 Minute, January 4)

Job gains spanned a range of industries including health care, food services, construction, manufacturing and retail trade. Although the unemployment rate rose marginally to 3.9 percent, more than half of the increase of unemployed persons was attributable to job leavers who either quit or voluntarily left their previous position. The report follows the troubling ISM Manufacturing Purchasing Manager Index data pushed out yesterday largely missed expectations provided another blow to sentiment.

With robust job gains in the United States taking the spotlight of America’s economic engine last year, the fast pace companies added employees brings into question the sustainability of employment growth for 2019. Economists project that the labor market will begin to soften over the next several months, but the exceptional data for December may cause markets to reevaluate their bearish bias that has dominated stocks and risk assets.

--Written by Rich Dvorak, Junior Analyst for DailyFX

--Follow Rich on Twitter @RichDvorakFX