Talking Points:

- Headline jobs growth comes in at +312K, and wage growth came in +3.2% y/y.

- The unemployment rate (U3) rose to 3.9% from 3.7%, but it came alongside a healthy expansion of the labor force participation rate from 62.9% to 63.1%.

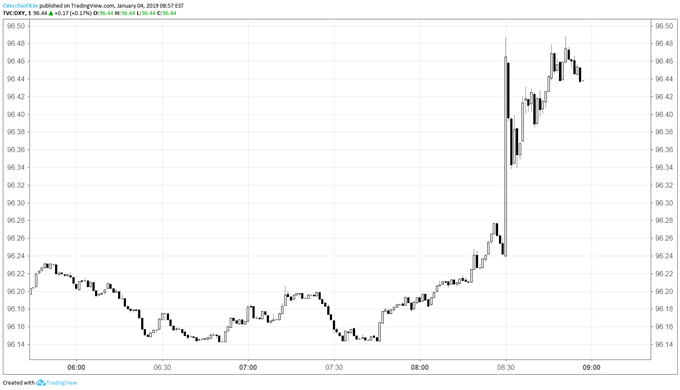

- The US Dollar gained ground immediately following the data, with the DXY Index rising from as low as 96.24 to as high as 96.49, at the time this report was written.

See Q1’19 forecasts for the US Dollar, Euro, British Pound and more with the DailyFX Trading Guides

The final jobs report for 2018 has been released, and it’s proven to be one of the better all-around jobs reports of the entire year. The December US Nonfarm Payrolls report showed headline jobs growth of +312K, blowing past expectations of +184K, according to Bloomberg News. The figure closely mirrored the large beat in the corresponding ADP Employment report released earlier this week.

Even though the unemployment rate (U3) unexpectedly rose to 3.9% from 3.7%, it did so alongside a healthy expansion of the labor market, with the labor force participation rate rising to 63.1% from 62.9%. In effect, the rise in the unemployment rate can be explained by the fact that there were more new entrants coming into the labor pool than there were available jobs.

Elsewhere, good news was sprinkled throughout the report. Wage growth remains strong, coming in above expectations at +3.2% (y/y). This reading is tied with October 2018 as the fastest pace of wage growth seen since April 2009.

Here are the data lifting the greenback this morning:

- USD Unemployment Rate (DEC): 3.9% versus 3.7% expected, unch.

- USD Change in Nonfarm Payrolls (DEC): +312K versus +184K expected, from +176K (revised higher from +155K).

- USD Labor Force Participation Rate (DEC): 63.1% from 62.9%.

- USD Average Hourly Earnings (DEC): +3.2% versus +3.0% expected, from +3.1% (y/y).

See the DailyFX economic calendar for Friday, January 4, 201 9

DXY Index Price Chart: 1-minute Timeframe (January 4, 2019 Intraday)

Immediately following the data, the US Dollar traded higher versus the Euro and the Japanese Yen, with the Dollar Index (DXY) rallying from 96.24 to as high as 96.49 in the wake of the report. By the time this report was written, the US Dollar was affirming its gains. EUR/USD, which traded as low as 1.1364 after the release intially, was holding at 1.1367 at the time of writing.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX