NFP Analysis and Talking Points

- US Nonfarm Payrolls rose by 155k in November, missing expectations of 198k expected; Prior month revised Lower

- US Average Hourly Earnings on the month falls short of consensus

See our latest Q4 FX forecast to learn what will drive the currency through the quarter.

NFP Report Review

US Bureau of Labor Statistics reported total nonfarm payroll (NFP) employment expanded by a 155k jobs in November, missing expectations of 198k. Alongside this, the headline figure for the prior month saw slight downward revision to 237k from 250k, resulting in a 2-month net revision of -12k. The unemployment rate remained at the lowest level since 1969 at 3.7%, which will continue to the delight of Fed officials given that they see NAIRU at 4.5%.

Wage Growth Holds Above 3%

The Fed focussed wage data rose in line with expectations for the yearly rate at 3.1%. However, monthly rate slightly disappointed expectations, rising 0.2%, short of the 0.3% expected, while the prior month saw a downward revision to 0.1%. Overall, despite the disappointment in today’s report, this does not change the outlook for the Fed. That said, the average gains in jobs for 2018 has been at 206k compared to 183k in 2017.

Market Response

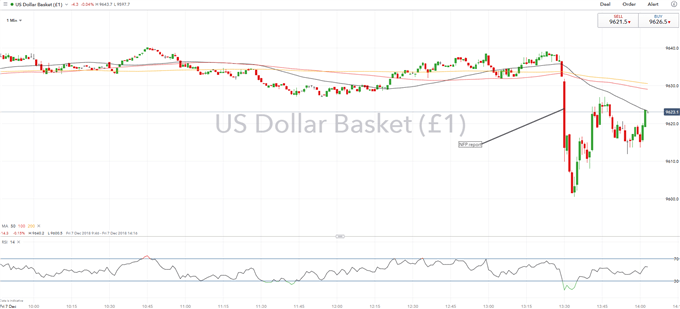

The soft jobs reports saw a weaker US Dollar upon release to pare its earlier advances with the DXY trading in the middle of its daily range. The move however was relatively minimal judging by historical standards, given that the report does not alter the Fed outlook a great deal.

DXY Price Chart 1: 1-minute time frame (Intra-day)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX