Sterling, Brexit and the US Dollar:

- Deal, no deal, delayed Brexit, no Brexit vote – the permutations increase daily.

- GBPUSD respects support but backdrop favors another test shortly.

Q4 Trading Forecasts including USD and GBP.

Sterling (GBP) Likely to Re-Test Support

The UK Parliamentary vote on PM May’s Brexit deal, scheduled for December 11, may be delayed according to the latest round of rumors, to give the beleaguered PM more time to shore up support for her increasingly unpopular deal.PM May is facing increasing criticism from all sides over her Brexit deal and has now said that there are three options; her deal, no deal or no Brexit, echoing comments made by the President of the European Council Donald Tusk last week. The addition of a no Brexit option is a new development by PM May who has always argued that no deal is better than a bad deal. In addition, the European Court of Justice (ECJ) who recently opined that the UK could unilaterally revoke Article 50 and stay in the EU, tweeted that a ruling will be delivered on December 10, one day before the vote in Parliament.

GBPUSD: Current Brexit Deal Won’t Pass Through UK Parliament

Brexit Impact on GBP: How the Pound Might Move After Parliamentary Vote

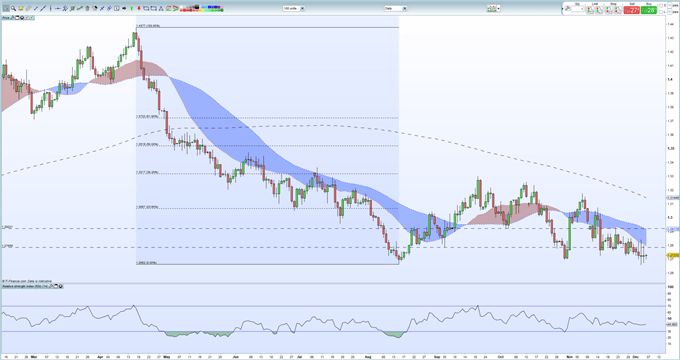

Against this fragile and ever-changing background, GBPUSD continues to trade just above 1.2700, around half-a-cent above its recent multi-month low print around 1.2660. Price action remains negative with the downtrend from the November 7 high still in place, while the pair trade below all three moving averages. The RSI indicator is relatively stable despite the weak market outlook.

GBPUSD Daily Price Chart (February – December 6, 2018)

Retail traders are 67.4% net-long GBPUSD, according to the latest IC Client Sentiment Data, a bearish contrarian indicator. However, recent changes in daily and weekly positions currently give us a mixed trading bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.