Gold Price Analysis and Talking Points:

- Gold Eyes Topside Breakout

- Investors Net Short on Gold Increases Upside Scope

See our quarterly gold forecast to learn what will drive prices through mid-year!

Gold Eyes Topside Breakout

The precious metal is yet again on the front foot with Gold eying a topside breakout as it tests the October peak ($1243). A softer USD and firmer Yuan following the trade war truce post the G20 summit had been the initial catalyst behind the bid in Gold. The USD has continued to sag with US yields continuing to dip, which in turn has reduced demand for the Dollar, particularly given that US yield curve have been starting to invert (2s5s and 3s5s). The all-important 2s10s curve tightened by a sizeable 8bps and now is 14bps away from inverting.

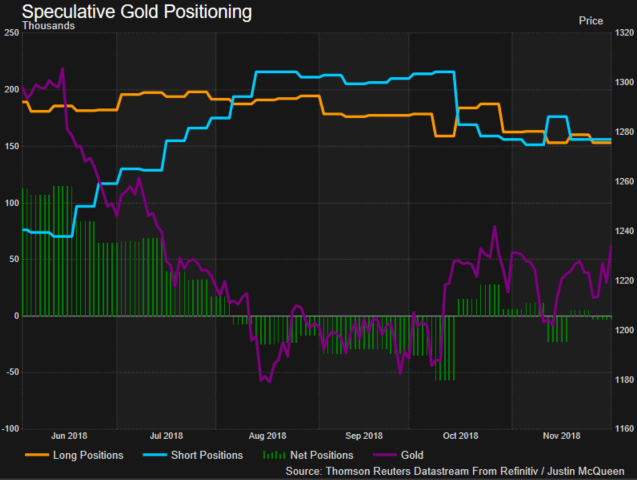

Investors Net Short on Gold Increases Upside Scope

Despite gold prices trading at the highest level in a month, investors remain cautiously bearish on the precious metal, which has been reflected in the latest CFTC data. Speculators are currently net short on gold albeit marginally so. Given the net short positioning however, risks are skewed to the upside with the potential for a bullish reversal. Short positioning has continued to pullback from the YTD peak in October, while long positioning remains stable, further increasing scope for upside.

Weekly Gold Forecast

What You Need to Know About the Gold Market

GOLD PRICE CHART: Daily Time-Frame (Mar-Dec 2018)

Gold bulls are now eyeing a move towards the October peak sitting at $1243, a break above opens up room for a test of the 50% Fibonacci retracement at $1262. However, a notable risk event would be needed for this to be tested, which may come in the form of Friday’s NFP report. As it stands, resistance at $1240-43 holds for now.

GOLD TRADING RESOURCES:

- See our quarterly gold forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX