Risk Assets, G20 Trade Truce Talking Points:

- The US and China have agreed to pause trade hostilities

- That’s progress, at least, and risk appetite has increased

- However there remains much more to do

Fourth-quarter technical and fundamental forecasts from the DailyFX analysts are out now.

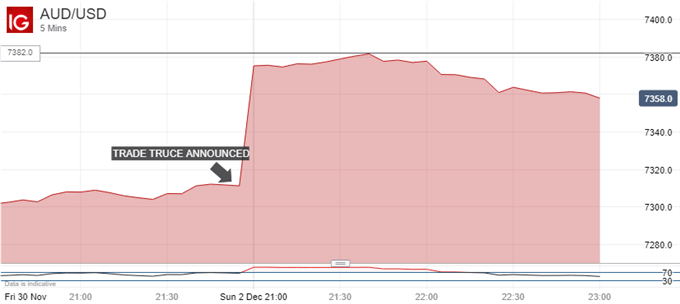

Nothing perhaps better epitomizes global reaction to last weekend’s trade truce between China and the US than the reaction of the Australian Dollar.

The currency leaped as the news broke from the Group of 20 meeting in Argentina, charging up to highs not seen since July against its US big brother.

This makes perfect sense on many levels. For one thing, Australia relies on China for much of its trade and on the US for much of its security. It was hugely exposed to the prospect of a trade war between the two. That might have forced it to pick a side, with damaging consequences either way. Versions of Australia’s dilemma would have played our around the world, so news of a reprieve has been broadly welcomed.

The Australian Dollar is also a ‘growth currency’ –largely thanks to its home country’s status as a raw-material export powerhouse. It tends to find a lot more favor when investors are upbeat about global growth prospects. A US/China trade war was the greatest threat to those prospects. Dial back the threat and you dial back the Aussie headwinds.

This rubric applies to varying degrees across all similar units, so the New Zealand and Canadian Dollars have also done well at the expense of perceived havens such as the Japanese Yen. As for the US Dollar overall, well, the markets were just starting to wonder whether they might not have overpriced the chances of higher interest rates from the Federal Reserve next year. If the current trade truce becomes a full-scale trade deal, then the higher-rate path will probably be back and the US Dollar should gain.

Crude oil prices have been falling since early October, not least as markets have fretted demand for the stuff in a world where China and the US are putting up trade barriers.

Intuitively then the market should probably turn around at least to some extent, if it becomes clear that the two counties will reach a deal.

However, that remains a big ‘if.’

The markets have been quick to jump on this sign of hope from Argentina, and so they should. But it remains a holiday-season reprieve and, so far, nothing more. US and Chinese trade negotiators now have 90 days to hammer out a slew of pressing problems, from the rules over technology transfer and cyber intrusions through to more conventional intellectual property protection.

Both US President Donald Trump and his Chinese counterpart Xi Jinping needed at least a sign of progress to take home with them. They have it, but more must be done if the current risk-appetite boost is to last long into 2019. With the Chinese economy showing clear signs of deceleration, Mr, Xi will want to avoid higher US tariffs if he can.

It’s perhaps telling that the oldest haven of all, gold, has shown relatively little reaction to the story so far. Indeed it remains in the daily-chart uptrend which has been in place since August.

The message from markets could not be clearer. China and the US have broken the ice, and that’s a great start. But they need to move quickly to ensure that it doesn’t freeze over once again.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!