Sterling and Brexit Latest:

- UK economy is expected to be worse off under all forms of Brexit.

- Sterling may nudge lower but negative news already factored in.

We have just released our Brand New Q4 Trading Forecasts including USD and GBP.

Sterling (GBP) Treads Water Ahead of Official Brexit Analysis

The British Pound is marginally higher in early turnover as it waits for the release of the government’s official analysis of the potential long-term effects on the UK economy ofvarious forms of Brexit. According to media reports the cost to the economy will range between GBP40 billion and GBP150 billion over 15 years with no outcome producing a positive benefit. The report is expected to be released at 16:30 GMT. Some commentators have opined that today’s release is analysis and not an official forecast, while former Brexit minister Dominic Raab said that he expects a re-hash of Project Fear today, adding that the Treasury has a credibility gap based on their track record of failure.

Ahead of the release, Sterling continues to trade sideways with little reason to make any decisive move. A slightly weaker US dollar has helped GBPUSD to nudge slightly higher to 1.2770, while EURGBP is marginally lower at 0.8840 with the single currency a touch lower on continued Italian Budget worries and ongoing Euro-Zone growth concerns. In addition, unofficial commentary Tuesday that the US is looking to impose a 25% tariff on European car imports also weighed on the currency.

Sterling Ignores EU/UK Brexit Deal as Challenges Increase.

EURGBP: Pending Long as Support Nears – Tight Stop.

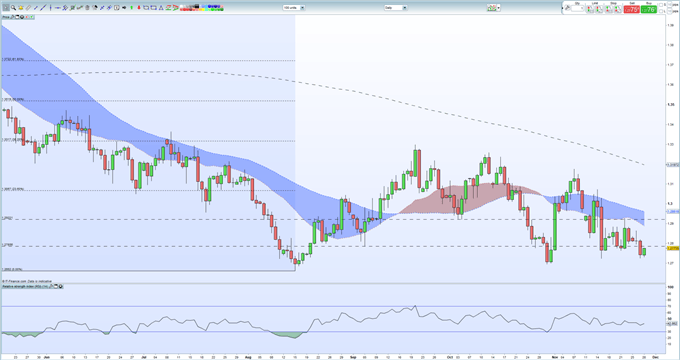

GBPUSD Daily Price Chart (May – November 28, 2018)

IG Client Retail Sentiment shows that traders are 76.1% net-long GBPUSD, a bearish contrarian signal. In addition, recent daily and weekly positional changes give suggest a stronger bearish GBPUSD trading bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.