Bitcoin (BTC) and Ripple (XRP): Prices, Charts and Analysis

- Cryptocurrency market continues to struggle with ‘dip buying’ absent.

- Further losses could accelerate due to fragile market conditions.

Cryptocurrency Market’s Continued Weakness

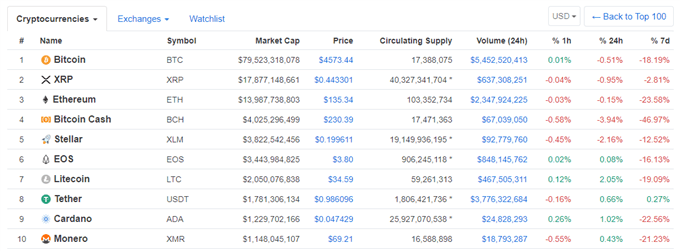

Bitcoin and Ripple - the two largest coins by market capitalization – still languish near their multi-month lows as the expected ‘buy the dip’ crowd remain noticeable by the absence. Over the last few months, most sharp falls in the cryptocurrency market have been followed by a reasonable rebound – dip buyers – before the market stabilized and moved lower again. This week’s heavy sell-off however - most coins are down between 25% and 40% - has sparked little buying interest, leaving prices vulnerable to fresh falls.

IG Sentiment Data show how retail traders are positioned in various cryptocurrencies and how changes in holdings can affect market sentiment. Retail traders remain long of Bitcoin (76.2%) but the number of traders net-short has jumped by 27.7% from last week. Ripple continues to show a market heavily skewed towards the long side with retail 96.1% net-long the coin. See how these daily and weekly changes affect our trading sentiment/bias for a range of cryptocurrencies.

Recent Cryptocurrency Articles:

Bitcoin, Ethereum, Ripple News – Recovery Weak, Support Lacking

Bitcoin, Ethereum, Ripple Prices – Cryptocurrency Carnage Continues

Bitcoin, Ethereum, Ripple Prices Collapse Further – A Sea of Red

Previous levels of Bitcoin support have now changed to resistance with a cluster situated around $6,000. The next level of support remains at $2,970, the September 2017 swing-low. Bitcoin remains oversold according to the RSI indicator which may provide some downside protection in the short-term.

Bitcoin (BTC) Daily Price Chart (January – November 22, 2018)

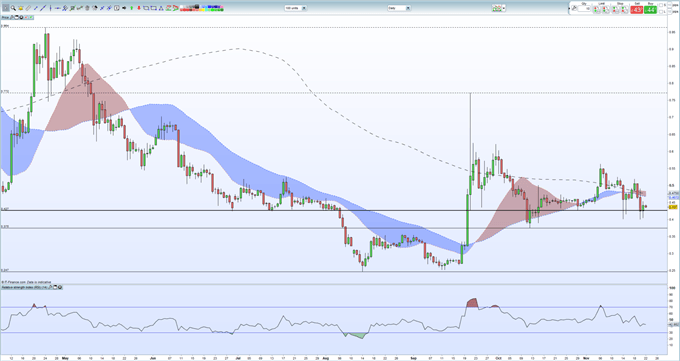

Ripple also remains vulnerable to further losses with a break below $0.427 opening the way to $0.375. The coin has just moved under all three moving averages and is likley to test support over the coming days. On the upside, the moving average cluster around $0.48 may prove a tough test.

Ripple (XRP) Daily Price Chart (April – November 22,2018)

We look at Bitcoin, Ethereum, Ripple, Bitcoin Cash and a variety of other cryptocurrencies, at our Weekly Cryptocurrency Webinar every Wednesday.

Cryptocurrency Trader Resources – Free Practice Trading Accounts, Guides, Sentiment Indicators and Webinars

If you are interested in trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin or Ripple we can help you begin your journey with our Introduction to Bitcoin Trading Guide.

What’s your opinion on the cryptocurrency market? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.