Euro, Italian Budget, German GDP and US dollar:

- German economy contracts in Q3.

- Italy and Brussels on a collision course.

We have just released our Brand New Q4 Trading Forecasts including USD and EUR.

EURUSD Stuck Under 1.1300 on Poor German Growth Data and Italian Budget

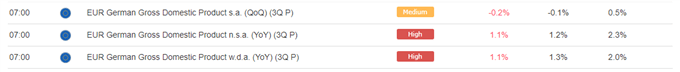

The latest German GDP figures revealed the counties economy contracted in the third-quarter, fueling fears of a continued slowdown. The Q3 GDP release showed growth contracted by 0.2%, compared to an expansion of 0.5% in Q2, while annual growth fell to 1.1%.

Euro-Zone Q3 GDP data remained in line with market expectations with quarterly growth of 0.2% and an annual rate of 1.7%.

Late Tuesday, the Italian government rejected EU demands to amend its budget plans, leaving its growth target of 1.5% and its deficit projection of 2.4% unchanged, in a move that will likely spark disciplinary measures from Rome. The Italian government said that the 2.4% deficit target was a red line but that it would consider selling state assets to help boost GDP. The 10-year German/Italy government bond spread – an indicator of market stress – widened out by around 10 basis points to 313bps. The spread recently traded at 340bps, the highest level since April 2013.

Italian Budget Primer - Euro to Sink Further as Rome Clashes with Brussels Over Budget.

IG Client Sentiment Data show investors are currently 61.6% net-long EURUSD – a contrarian bearish signal – however recent daily and weekly positional shifts suggest that EURUSD may move higher despite traders remaining net-long.

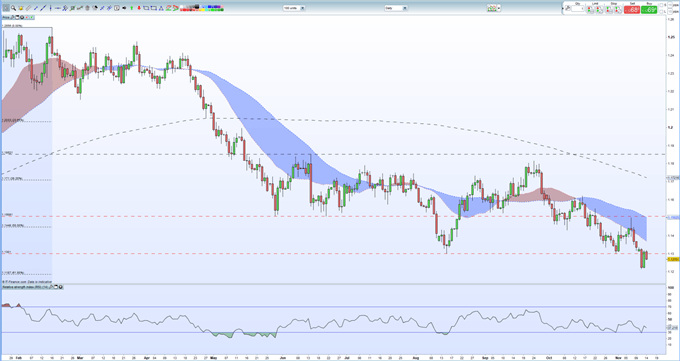

EURUSD remains stuck under 1.1300 – the August 15 swing low – and is likely to fall further with initial support at the 61.8% Fibonacci retracement level at 1.1187. The pair are currently trading around 1.1268, aided in part by a slightly weaker US dollar. The US dollar basket (DXY) is quoted at 96.77, down from Monday’s 17-month of 97.16.

EURUSD Daily Price Chart (June 2017 – November 14, 2018)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.

https://www.dailyfx.com/forex/market_alert/2018/11/13/Euro-to-Sink-Further-as-Rome-Clashes-with-Brussels-Over-Budget.html?ref-author=Cawley