Talking Points – Euro, Budget, EU, Italy

- Rome and Brussels are headed for showdown over budget, investors hold breath

- Political clout of economic nationalists dwindling, economic forecasts look grim

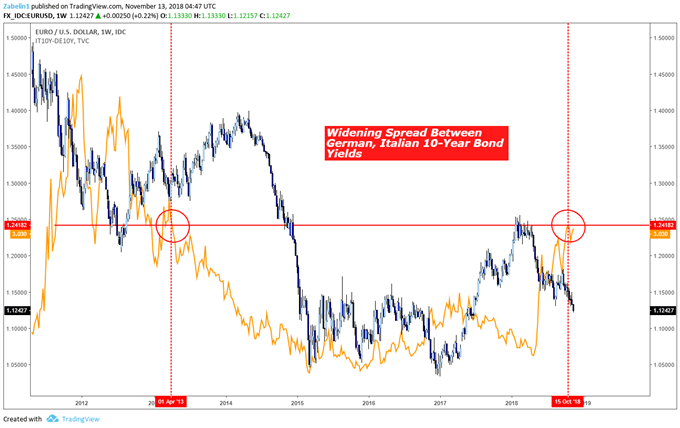

- Euro likely to fall further, spread between German and Italian bond yields to rise

See our Euro forecast to learn what is likely drive prices through year-end!

The Euro looks like it will continue its downward trend as uncertainty surrounding the Italian government’s controversial budget looms over investors. Brussels and Rome are headed for a budgetary showdown on November 13th. Economic nationalism has weighed the European unit down amid broader global risk aversion.

After the first draft was rejected, the EU Commission demanded a resubmission. The Italian government has affirmed it has no intention to radically alter its budgetary parameters. The regional authority is now sharpening its regulatory claws.

If Italy continues to break regional fiscal laws, they are required to follow a specific set of regulations known as the Excessive Deficit Procedure (EDP). This requires that they commit to a target that will bring deficits and debts back to statutory levels. If they cannot propose a fiscal plan within regulatory parameters, they face the possibility of economic sanctions.

This puts the EU in a conundrum: if their penalties are too harsh and push Italy into a crisis, it would strengthen nationalist eurosceptics. Conversely, if they are too lenient, it may provoke populists in other EU member states to push their own rule-violating agenda and justify it through citing Italy’s fiscal exceptionalism.

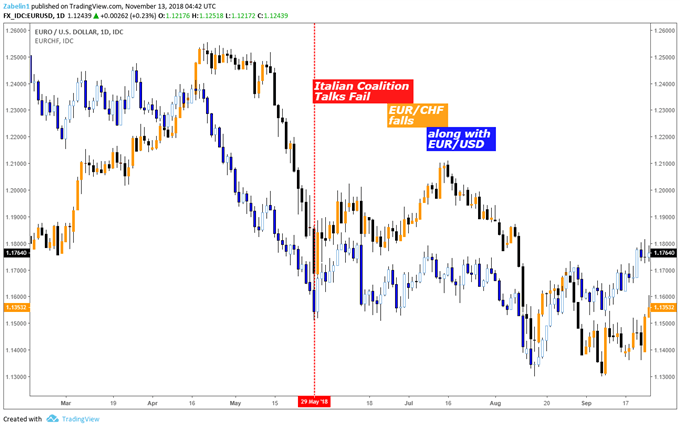

Financial markets have responded with risk aversion as the spread between German and Italian bonds widened. The increased political risk may cause a rise in demand for regional alternatives such as the Swiss Franc. If broader risk aversion follows, the Yen may also rise.

Rome is not likely to back down anytime soon or implement any meaningful reform due to the domestic risk of losing local voter support which has also begun to dwindle. This comes amid weak economic data from last month and the EU’s low forecasts for growth in Italy in 2019 and 2020.

The EU’s hard stance on applying uniform regulatory measures for all member states will continue to clash with Rome’s determination to push through their fiscal plan. That probably bodes ill for the Euro going forward.

EURO TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter