TALKING POINTS – AUD/USD, RBA, MIDTERM ELECTIONS, FOMC

- AUD/USD ralliedafter RBA left OCR unchanged, noted eventual inflation pickup

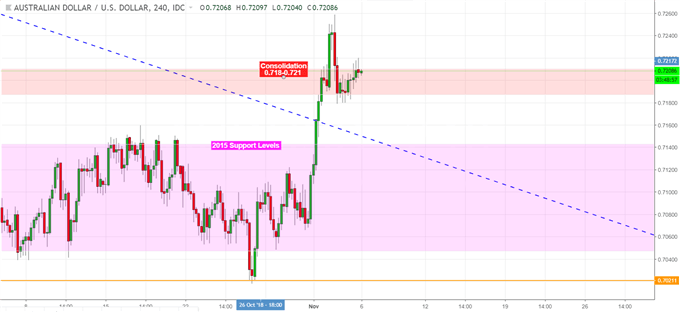

- Prices consolidating at 0.718-0.721 above 2018 downtrend, bearish reversal likely

- US midterm elections, FOMC rate decision, and RBA statement in spotlight next

Build confidence in your own AUD/USD strategy with the help of our free guide!

The Australian Dollar was cautiously higher against its US namesake after the Reserve Bank of Australia left its overnight cash rate unchanged at 1.50%. The central bank noted that its unchanged policy is consistent with meeting its sustainable two percent inflation goal. The monetary policy authority also stated that it sees a gradual pickup in inflation and that GDP growth will average 3.5% over the next couple of years.

AUD/USD Chart (5-minute)

Chart prepared in TradingView

The jump in prices may initially continue AUD/USD’s breakout above its 2018 dominant downtrend following a resurgence in risk appetite. However, due to interest rate differentials and slowing Australian growth, upside follow-through is likely lacking. Furthermore, the Aussie Dollar has recently set a new yearly low at 0.7021, before it faced resistance at levels that were formerly support.

AUD/USD Chart (Daily)

Chart prepared in TradingView

A four-hour chart may offer more cues to traders regarding an actionable set-up. Currently, the Aussie’s breakout appears to have lost momentum as the currency pair seems to be consolidating at the 0.718-0.721 levels. These may turn into resistance for the future if AUD/USD falls below the descending trend line. On the other hand, a daily close above this channel may indicate further momentum for the Australian Dollar’s bullish reversal.

AUD/USD Chart (4-hour)

Chart prepared in TradingView

Looking ahead, the sentiment-linked unit will continue to closely eye risk trends. AUD/USD may face volatility from the US midterm elections, possibly leading to a bearish reversal as the Aussie follows market mood. In addition, the currency pair will also be looking to the FOMC rate decision and the RBA’s statement on monetary policy later this week.

AUD/USD Trading Resources

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Australian Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Megha Torpunuri, DailyFX Research Team