Sterling (GBP) and Brexit Talking Points:

- Sterling rallies on financial services news.

- BoE will leave monetary policy unchanged; QIR/governor Carney comments key.

The DailyFX Q4GBP Forecast is available to download.

DailyFX analyst Justin McQueen will cover the BoE Meeting Live from 11.45 am.

Sterling Buoyed by Financial Services News

The EU and the UK have reached an agreement on financial services post-Brexit according to newspaper reports, which would allow UK firms access to the EU markets as long as a Brexit deal is agreed and if UK financial regulation remains broadly aligned with that of Europe. If these reports are confirmed, and they seem to be gaining traction as we write, the recent rally in Sterling may have more legs, especially after GBP’s weak performance over the last two weeks. Sterling’s fate however remains heavily dependent on the ongoing negotiations with neither side budging yet on the Irish border impasse. Even if a solution is found, any Brexit negotiation will still have to be passed by the UK Parliament where opinions remain heavily divided.

Brexit Effect on Pound and UK Stocks: Impact of Deal or No Deal

The Bank of England monetary policy meeting today, along with the latest Quarterly Inflation Report (QIR), will see all policy settings left untouched. The QIR may reveal slight revisions to inflation and growth forecasts with CPI nudged higher due to a weaker Sterling while growth remains Brexit-dependent. This report was written before the Autumn Budget statement and will not reflect any of post-statement optimism fueled by increased government spending.

IG Client Sentiment data show that retail investors are 79.4% net-long GBPUSD, a bearish contrarian indicator. However, recent daily and weekly shifts in sentiment give us a strong GBPUSD bearish bias.

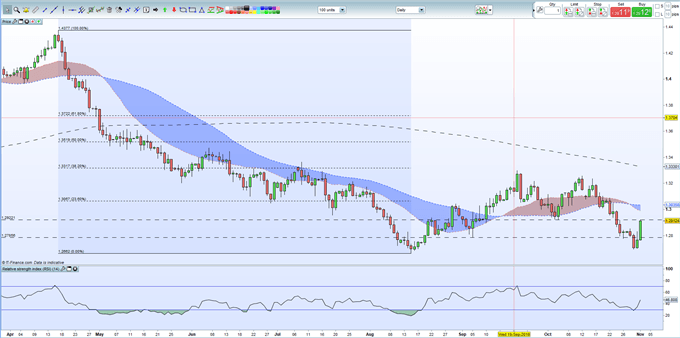

GBPUSD Daily Price Chart – November 1, 2018

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1