Bitcoin, Ethereum, Ripple: Prices, Charts and Analysis

- UK regulators warn on cryptocurrency derivatives.

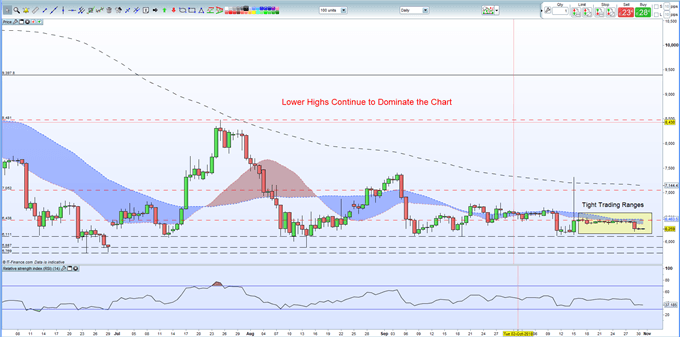

- Tight trading conditions may spark a sharp breakout.

UK Regulators May Stop Retail Traders Using Cryptocurrency Derivatives

The UK Cryptoasset Taskforce released a new report on Monday highlighting its concerns over retail traders use of various cryptocurrency derivatives. The report said that the authorities will consult on and may consider ‘a potential prohibition of the sale to retail consumers of derivatives referencing certain types of cryptoassets (for example, exchange tokens), including CFDs, options, futures and transferable securities’.

IG Sentiment Data show how retail traders are positioned in various cryptocurrencies and how changes in holdings can affect market sentiment. Retail traders remain heavily long of cryptocurrencies.

Cryptocurrencies Under Increased UK Regulatory Scrutiny

The cryptocurrency market lull continues with increasingly tight trading ranges and low volumes. Daily market turnover is currently around USD10 -12 billion, sharply lower than the USD50 billion+ seen in the three months around the turn of the year. This low volatility environment may lead to a breakout shortly with the downside looking more likely due to the market’s prevailing negative sentiment. Most charts show a ‘descending wedge’ pattern which also indicates a market breakdown may be imminent.

Bitcoin (BTC) Daily Price Chart (June - October 31, 2018)

We look at Bitcoin, and a variety of other cryptocurrencies, at our Weekly Cryptocurrency Webinar every Wednesday.

Cryptocurrency Trader Resources

If you are interested in trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin or Ripple we can help you begin your journey with our Introduction to Bitcoin Trading Guide.

What’s your opinion on the cryptocurrency market at the moment? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.