- UK Chancellor Philip Hammond to announce Autumn Budget.

- Bank of England ‘Super Thursday’ and BoE governor Carney.

The Brand New DailyFX Fourth Quarter Forecasts include a fresh look at GBP.

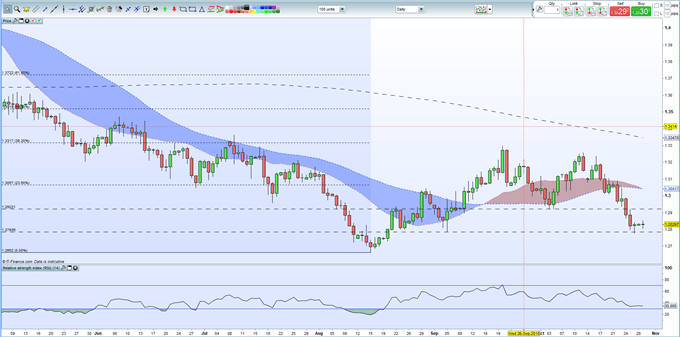

IG Sentiment Data show of traders are 76.9% net-long of GBPUSD, a bearish contrarian indicator. However recent daily and weekly sentiment shifts show retail further long GBPUSD giving us a stronger bearish contrarian bias.

I will be covering the Bank of England Monetary Policy Report live on Thursday November 1.

Busy Week Ahead in the UK, Europe and the US

A packed economic calendar in the UK and overseas will keep UK asset traders on their toes and may offer new opportunities. The week starts with the UK Autumn Budget where Chancellor Hammond has more money than previously thought to help grease the cogs of the UK economy. He is expected to warn however, and hold back some monies, of the effect and the Treasury’s planning of a no-deal Brexit. Later in the week, the latest UK monetary policy announcement from the central bank, with all monetary settings expected to be left unchanged. The Quarterly Inflation Report may see inflation and growth expectations trimmed as Brexit uncertainty continues to cloud the picture. In Europe, a raft of growth and inflation figures, while the week ends with the latest US non-farm payroll release.

The DailyFX Economic Calendar provides a detailed list of all major, global economic releases.

GBPUSD Daily Price Chart October 29, 2018

If you missed this webinar and would like to know about future events, you can see the full DailyFX webinar schedule here.

DailyFX has a vast amount of updated resources to help traders make more informed decisions. These include a fully updated Economic Calendar, Educational and Trading Guides and the constantly updated IG Client Sentiment Indicator.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1